Overview

Investment Strategy

The goal of the Fund is to create an opportunistic portfolio that can seek attractive businesses across all market caps, industries and sectors.

Using our signature Davis Investment Discipline, the Fund has outperformed the S&P 1500® Index since Davis began managing the Fund.

"By being highly selective and rejecting the vast majority of companies in the index, we’ve uncovered businesses with highly attractive earnings growth, yet selling at some of the lowest valuations we have ever seen. We believe this sets the stage for attractive returns in the years ahead.”

– Portfolio Manager Chris Davis

| Selective | Attractive Growth | Undervalued |

|---|---|---|

|

Opportunity Fund invests in only a select group of well-researched companies |

Opportunity Fund's portfolio companies have grown more than the companies in the index More information about Earnings The Attractive Growth and Undervalued reference in this piece relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Fund’s performance will be positive as equity markets are volatile and an investor may lose money. |

Opportunity Fund's portfolio companies are 40% less expensive than the index |

| Holdings More information about Holdings The number of holdings in the Fund excluding cash positions. | EPS Growth (5 Year) More information about EPS Five-year EPS Growth Rate (5-year EPS) is the average annualized earnings per share growth for a company over the past 5 years. The values shown are the weighted average of the 5-year EPS of the stocks in the Fund or Index. The 5-year EPS of the S&P 1500 is 16.4%. Approximately 10.94% of the assets of the Fund are not accounted for in the calculation of 5-year EPS as relevant information on certain companies is not available to the Fund’s data provider. | P/E (Forward) More information about P/E (Forward) Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Fund’s data provider. The Forward P/E of the S&P 1500 is 24.5x. These values for both the Fund and the Index are the weighted average of the stocks in the portfolio or index. |

|

1,506

47

|

||

|

Fund

S&P 1500

|

||

Fund Details as of 9/30/25

| Detail | Value |

|---|---|

| Long-Term Growth of Capital | |

| Total Net Assets ($M) | 605.4 |

| Benchmark | S&P 1500 |

| Lipper Category | Multi Cap Value |

A Shares

| Detail | Value |

|---|---|

| Ticker (A) | RPEAX |

| Inception Date (A) | 12/1/94 |

| CUSIP (A) | 239103104 |

| Fund Number (A) | 720 |

| Net Expense Ratio (A) More information about Net Expense Ratio Davis Selected Advisers, L.P. is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses (Class A Shares, 1.00%; Class C Shares, 1.75%; and Class Y Shares, 0.75%). The Adviser is obligated to continue the expense cap through May 1, 2026. The expense cap cannot be modified prior to this date without the consent of the Board of Directors. After that date, there is no assurance that the Adviser will continue to cap expenses. The Adviser may not recoup any of the operating expenses it has reimbursed to the Fund. As of the most recent prospectus. | 0.93% |

| Gross Expense Ratio (A) | 0.93% |

C Shares

| Detail | Value |

|---|---|

| Ticker (C) | DGOCX |

| Inception Date (C) | 8/15/97 |

| CUSIP (C) | 239103765 |

| Fund Number (C) | 822 |

| Net Expense Ratio (C) More information about Net Expense Ratio Davis Selected Advisers, L.P. is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses (Class A Shares, 1.00%; Class C Shares, 1.75%; and Class Y Shares, 0.75%). The Adviser is obligated to continue the expense cap through May 1, 2026. The expense cap cannot be modified prior to this date without the consent of the Board of Directors. After that date, there is no assurance that the Adviser will continue to cap expenses. The Adviser may not recoup any of the operating expenses it has reimbursed to the Fund. As of the most recent prospectus. | 1.75% |

| Gross Expense Ratio (C) | 1.76% |

Y Shares

| Detail | Value |

|---|---|

| Ticker (Y) | DGOYX |

| Inception Date (Y) | 9/18/97 |

| CUSIP (Y) | 239103831 |

| Fund Number (Y) | 912 |

| Net Expense Ratio (Y) More information about Net Expense Ratio Davis Selected Advisers, L.P. is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses (Class A Shares, 1.00%; Class C Shares, 1.75%; and Class Y Shares, 0.75%). The Adviser is obligated to continue the expense cap through May 1, 2026. The expense cap cannot be modified prior to this date without the consent of the Board of Directors. After that date, there is no assurance that the Adviser will continue to cap expenses. The Adviser may not recoup any of the operating expenses it has reimbursed to the Fund. As of the most recent prospectus. | 0.68% |

| Gross Expense Ratio (Y) | 0.68% |

Returns from Inception as of 9/30/25

| Item | Value |

|---|---|

| A Shares (Average Annual Return, without a sales charge) | 10.91% |

| Average Fund in Lipper Category | 9.57% |

Resources

| Document |

|---|

| PM Commentary |

| Factsheet |

Performance as of 9/30/25

Growth of $10,000 (Class A Shares since 1999, without a sales charge)

Outperformed the S&P 1500® Index since Davis assumed management in 1999

Average Annual Returns

A Shares: Quarterly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

A Shares without a sales charge |

16.54% | 13.15% | 22.03% | 14.91% | 12.60% | 10.91% |

|

|

A Shares with a maximum 4.75% sales charge |

11.01% | 7.77% | 20.09% | 13.81% | 12.07% | 10.74% |

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

A Shares: Monthly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

A Shares without a sales charge |

16.54% | 13.15% | 22.03% | 14.91% | 12.60% | 10.91% |

|

|

A Shares with a maximum 4.75% sales charge |

11.01% | 7.77% | 20.09% | 13.81% | 12.07% | 10.74% |

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

C Shares: Quarterly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

C Shares without CDSC |

15.85% | 12.23% | 21.04% | 13.97% | 11.88% | 8.52% |

|

|

C Shares with CDSC |

14.85% | 11.32% | 21.04% | 13.97% | 11.88% | 8.52% |

Class C shares automatically convert to Class A shares after eight years. Class C shares’ performance for the periods exceeding eight years include the first eight years of Class C share performance and Class A share performance thereafter.

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

C Shares: Monthly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

C Shares without CDSC |

15.85% | 12.23% | 21.04% | 13.97% | 11.88% | 8.52% |

|

|

C Shares with CDSC |

14.85% | 11.32% | 21.04% | 13.97% | 11.88% | 8.52% |

Class C shares automatically convert to Class A shares after eight years. Class C shares’ performance for the periods exceeding eight years include the first eight years of Class C share performance and Class A share performance thereafter.

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

Y Shares: Quarterly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

Y Shares | 16.80% | 13.44% | 22.35% | 15.19% | 12.88% | 8.86% |

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

Y Shares: Monthly (as of 9/30/25)

|

|

|||||||

|---|---|---|---|---|---|---|---|

| Share Class | YTD* | 1 Yr | 3 Yr | 5 Yr | 10 Yr | Since Incep | |

|

|

Y Shares | 16.80% | 13.44% | 22.35% | 15.19% | 12.88% | 8.86% |

The average annual total returns for Davis Opportunity Fund’s Class A shares for periods ending September 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 7.77%; 5 years, 13.81%; and 10 years, 12.07%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.93%. [The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.00%. The expense cap expires May 1, 2026.] The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. Periods less than one year are not annualized.

Portfolio Characteristics as of 9/30/25

Portfolio Composition

| Item | Opportunity Fund | S&P 1500® |

|---|---|---|

| P/E (Forward) More information about P/E (Forward) Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Fund’s data provider. The Forward P/E of the S&P 1500 is 24.5x. These values for both the Fund and the Index are the weighted average of the stocks in the portfolio or index. | 14.6x | 24.5x |

| 5 Year Earnings Growth | 24.5% | 16.4% |

| P/B Ratio More information about P/B Ratio Price/Book (P/B) Ratio is the weighted average of the P/B ratios of the stocks in a portfolio. The P/B ratio of a stock is calculated by dividing the current price of the stock by the company’s per share book value. Stocks with negative book values are excluded for this calculation. | 2.9 | 4.8 |

| Active Share More information about Active Share Active Share is a measure of the percentage of stock holdings in a manager's portfolio that differ from the benchmark index. | 88% | N/A |

| Standard Deviation (5 year, A Shares) More information about Standard Deviation Standard Deviation is a measure of the average deviations of a return series from its mean; often used as a risk measure. A large standard deviation implies that there have been large swings or volatility in the manager’s return series. | 17.3 | 15.9 |

| Number of Holdings | 47 | 1506 |

| Weighted Average Market Cap ($bn) More information about Weighted Average Market Cap Weighted Average Market Capitalization is the portfolio-weighted mean capitalizations of all equity securities. | 267.6 | 1,187.6 |

| Median Market Cap ($bn) More information about Median Market Cap Median Market Capitalization is the midpoint of market capitalization of the stocks in a portfolio. | 72.0 | 6.5 |

| Opportunity Fund | Multi Cap Value Category Average | |

|---|---|---|

| Turnover Rate More information about Turnover Rate Turnover Rate is a measure of the trading activity in a mutual fund’s investment portfolio that reflects how often securities are bought and sold. These amounts are as of the most recent prospectus. Over the last five years, the high and low turnover rate was 24% and 9%, respectively. | 23% | 63% |

Portfolio Holdings More information about Portfolio Holdings The information provided should not be considered a recommendation to buy, sell or hold any particular security. Davis Funds has adopted a Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding information. This policy is described in the prospectus. Holding percentages are subject to change.

Top 10 Holdings: Quarterly (as of 9/30/25)

| Holding | Ticker | Opportunity Fund | S&P 1500® |

|---|---|---|---|

| Quest Diagnostics | DGX | 6.7% | < 0.1% |

| Capital One Financial | COF | 6.2% | 0.2% |

| Markel Group | MKL | 5.1% | — |

| Viatris | VTRS | 4.5% | < 0.1% |

| Wesco International | WCC | 4.0% | < 0.1% |

| Teck Resources | TECK | 3.9% | — |

| CVS Health | CVS | 3.8% | 0.2% |

| U.S. Bancorp | USB | 3.6% | 0.1% |

| Solventum | SOLV | 3.4% | < 0.1% |

| AppLovin | APP | 3.2% | 0.3% |

| Total | 44.4% | 0.9% | |

Top 10 Holdings: Monthly (as of 9/30/25)

| Holding | Ticker | Opportunity Fund | S&P 1500® |

|---|---|---|---|

| Quest Diagnostics | DGX | 6.7% | < 0.1% |

| Capital One Financial | COF | 6.2% | 0.2% |

| Markel Group | MKL | 5.1% | — |

| Viatris | VTRS | 4.5% | < 0.1% |

| Wesco International | WCC | 4.0% | < 0.1% |

| Teck Resources | TECK | 3.9% | — |

| CVS Health | CVS | 3.8% | 0.2% |

| U.S. Bancorp | USB | 3.6% | 0.1% |

| Solventum | SOLV | 3.4% | < 0.1% |

| AppLovin | APP | 3.2% | 0.3% |

| Total | 44.4% | 0.9% | |

All Holdings: Quarterly (as of 9/30/25)

| Holding | Ticker | Opportunity Fund | S&P 1500® |

|---|---|---|---|

| Quest Diagnostics | DGX | 6.7% | < 0.1% |

| Capital One Financial | COF | 6.2% | 0.2% |

| Markel Group | MKL | 5.1% | — |

| Viatris | VTRS | 4.5% | < 0.1% |

| Wesco International | WCC | 4.0% | < 0.1% |

| Teck Resources | TECK | 3.9% | — |

| CVS Health | CVS | 3.8% | 0.2% |

| U.S. Bancorp | USB | 3.6% | 0.1% |

| Solventum | SOLV | 3.4% | < 0.1% |

| AppLovin | APP | 3.2% | 0.3% |

| MGM Resorts | MGM | 3.1% | < 0.1% |

| DiDi Global | DIDIY | 3.0% | — |

| Coterra Energy | CTRA | 2.9% | < 0.1% |

| Tourmaline Oil | TOU CN | 2.9% | — |

| Applied Materials | AMAT | 2.7% | 0.3% |

| Cigna Group | CI | 2.7% | 0.1% |

| Owens Corning | OC | 2.5% | < 0.1% |

| Tyson Foods | TSN | 2.3% | < 0.1% |

| Prosus | PRX NA | 2.3% | — |

| Meta Platforms | META | 2.1% | 2.6% |

| Alphabet | GOOG | 2.0% | 1.9% |

| AGCO | AGCO | 1.7% | < 0.1% |

| Samsung Electronics | 005930 KS | 1.6% | — |

| Texas Instruments | TXN | 1.4% | 0.3% |

| UnitedHealth Group | UNH | 1.3% | 0.5% |

| Darling Ingredients | DAR | 1.3% | < 0.1% |

| Microsoft | MSFT | 1.2% | 6.3% |

| Berkshire Hathaway | BRK B | 1.2% | 1.5% |

| Vale | VALE | 1.1% | — |

| Schneider Electric | SU FP | 1.1% | — |

| Sea | SE | 1.1% | — |

| Delivery Hero | DHER GR | 1.1% | — |

| NVIDIA | NVDA | 1.1% | 7.4% |

| Oracle | ORCL | 1.0% | 0.8% |

| Johnson Controls International | JCI | 1.0% | 0.1% |

| PINS | 1.0% | — | |

| Amazon.com | AMZN | 0.9% | 3.5% |

| SAP | SAP | 0.6% | — |

| Synopsys | SNPS | 0.6% | 0.2% |

| Meituan | 3690 HK | 0.5% | — |

| Humana | HUM | 0.5% | 0.1% |

| Taiwan Semiconductor Manufacturing | 2330 TT | 0.4% | — |

| Trip.com Group | TCOM | 0.3% | — |

| JD.com | JD | 0.3% | — |

| IAC | IAC | 0.2% | — |

| ANGI | ANGI | 0.1% | — |

| ASAC II | ASAC LP | < 0.1% | — |

| CASH | — | 4.2% | — |

All Holdings: Monthly (as of 9/30/25)

| Holding | Ticker | Opportunity Fund | S&P 1500® |

|---|---|---|---|

| Quest Diagnostics | DGX | 6.7% | < 0.1% |

| Capital One Financial | COF | 6.2% | 0.2% |

| Markel Group | MKL | 5.1% | — |

| Viatris | VTRS | 4.5% | < 0.1% |

| Wesco International | WCC | 4.0% | < 0.1% |

| Teck Resources | TECK | 3.9% | — |

| CVS Health | CVS | 3.8% | 0.2% |

| U.S. Bancorp | USB | 3.6% | 0.1% |

| Solventum | SOLV | 3.4% | < 0.1% |

| AppLovin | APP | 3.2% | 0.3% |

| MGM Resorts | MGM | 3.1% | < 0.1% |

| DiDi Global | DIDIY | 3.0% | — |

| Coterra Energy | CTRA | 2.9% | < 0.1% |

| Tourmaline Oil | TOU CN | 2.9% | — |

| Applied Materials | AMAT | 2.7% | 0.3% |

| Cigna Group | CI | 2.7% | 0.1% |

| Owens Corning | OC | 2.5% | < 0.1% |

| Tyson Foods | TSN | 2.3% | < 0.1% |

| Prosus | PRX NA | 2.3% | — |

| Meta Platforms | META | 2.1% | 2.6% |

| Alphabet | GOOG | 2.0% | 1.9% |

| AGCO | AGCO | 1.7% | < 0.1% |

| Samsung Electronics | 005930 KS | 1.6% | — |

| Texas Instruments | TXN | 1.4% | 0.3% |

| UnitedHealth Group | UNH | 1.3% | 0.5% |

| Darling Ingredients | DAR | 1.3% | < 0.1% |

| Microsoft | MSFT | 1.2% | 6.3% |

| Berkshire Hathaway | BRK B | 1.2% | 1.5% |

| Vale | VALE | 1.1% | — |

| Schneider Electric | SU FP | 1.1% | — |

| Sea | SE | 1.1% | — |

| Delivery Hero | DHER GR | 1.1% | — |

| NVIDIA | NVDA | 1.1% | 7.4% |

| Oracle | ORCL | 1.0% | 0.8% |

| Johnson Controls International | JCI | 1.0% | 0.1% |

| PINS | 1.0% | — | |

| Amazon.com | AMZN | 0.9% | 3.5% |

| SAP | SAP | 0.6% | — |

| Synopsys | SNPS | 0.6% | 0.2% |

| Meituan | 3690 HK | 0.5% | — |

| Humana | HUM | 0.5% | 0.1% |

| Taiwan Semiconductor Manufacturing | 2330 TT | 0.4% | — |

| Trip.com Group | TCOM | 0.3% | — |

| JD.com | JD | 0.3% | — |

| IAC | IAC | 0.2% | — |

| ANGI | ANGI | 0.1% | — |

| ASAC II | ASAC LP | < 0.1% | — |

| CASH | — | 4.2% | — |

Sector Allocation More information about Sector Allocation The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

| Sector | Opportunity Fund | S&P 1500® |

|---|---|---|

| Health Care | 24.0% | 8.9% |

| Financials | 16.8% | 13.9% |

| Information Technology | 14.4% | 33.2% |

| Industrials | 14.0% | 9.3% |

| Consumer Discretionary | 10.1% | 10.7% |

| Energy | 6.1% | 3.0% |

| Communication Services | 5.7% | 9.5% |

| Materials | 5.3% | 2.0% |

| Consumer Staples | 3.7% | 4.9% |

| Utilities | — | 2.4% |

| Real Estate | — | 2.3% |

Market Cap Breakout More information about Market Cap Breakout The ranges reflected for large, mid, and small cap reflect the current ranges utilized by the S&P Composite 1500 Market Cap Guidelines, as may be amended from time to time. The current ranges are: large-capitalization, over $22.7 billion; mid-capitalization, between $8.0 billion and $22.7 billion; small-capitalization, under $8.0 billion.

| Opportunity Fund | ||

|---|---|---|

| Market | Percentage | |

|

|

Large | 53.4% |

|

|

Mid | 40.1% |

|

|

Small | 6.5% |

| S&P 1500® Index | ||

|---|---|---|

| Market | Percentage | |

|

|

Large | 89.3% |

|

|

Mid | 6.6% |

|

|

Small | 4.1% |

PM Commentary

Portfolio Manager Commentaries

| Document | Description |

|---|---|

| Manager Commentary - Semi-Annual Review 2025 | An interview with the Fund Managers. |

Factsheet

Fact Sheets

| Document | Description | Date |

|---|---|---|

| Fund Fact Sheet | Goals of the Fund, types of companies in the Portfolio, top holdings, Portfolio characteristics, and historical performance. | June 2025 |

Video

Video Insights

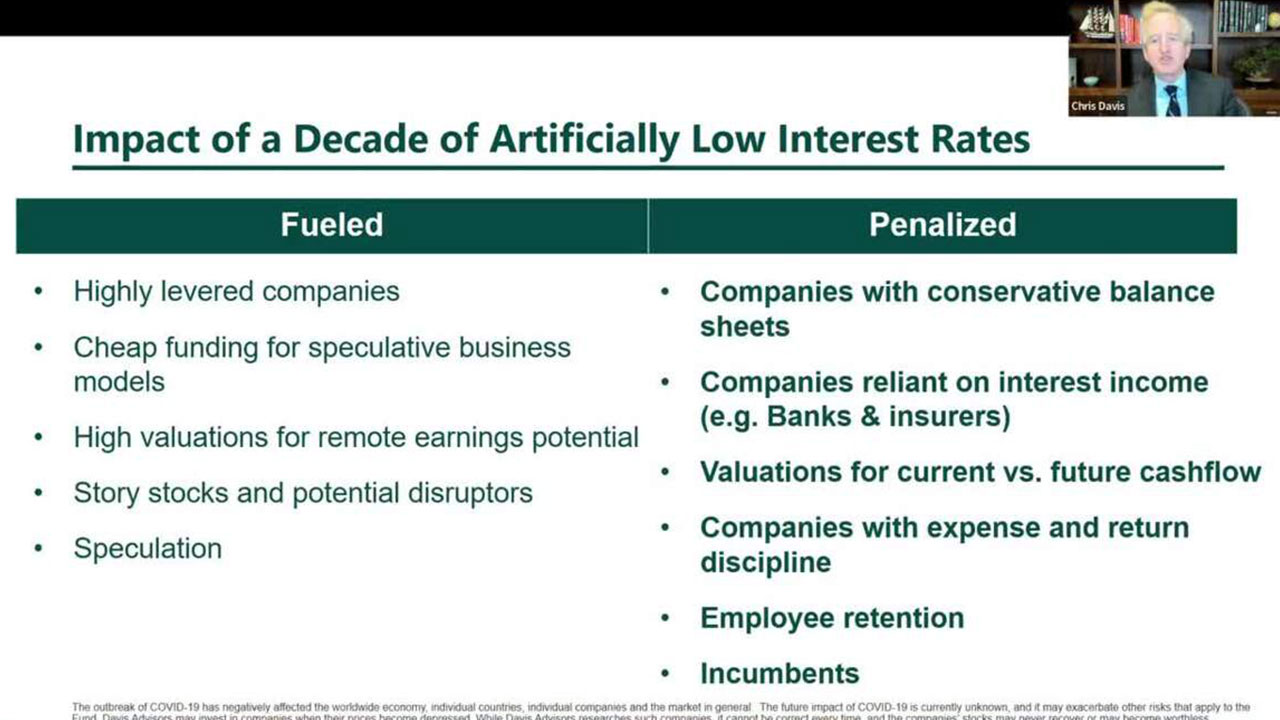

Market Distortions Caused by Historically Low Rates

We believe that select Banks may be among the best opportunities in the market today, as investors significantly overestimate the risks and underestimate the upside potential of these durable businesses

“Fragile Value” & “Speculative Growth” Areas to Avoid

Identifying vulnerable companies in both the Value and Growth camps – each dangerous in their own ways

Recession Potential and Impact on Portfolio Positioning

Predicting is futile. Buy businesses that have proven resilient through the inevitable storms. Investors are now being reminded of the critical importance of business durability.

Insights

Fund Insights

| Document | Description |

|---|---|

| Davis Opportunity Fund: Selective. Attractive Growth. Undervalued. | Our companies are rigorously researched, offer attractive growth and yet are significantly undervalued versus the benchmark - A powerful combination. |

| Davis Research: Uncovering Value in Clean Energy | The challenges and opportunities that accompany the transition to a lower carbon economy, separating hype from reality, and why our copper and biofuel businesses may be significant beneficiaries |

Literature

Regulatory Reports

| Document |

|---|

| Summary Prospectus |

| Prospectus |

| Statement of Additional Information |

| Holdings Q1 |

| Holdings Q3 |

| Proxy |

| Document |

|---|

| Annual Report - Class A |

| Annual Report - Class C |

| Annual Report - Class Y |

| Annual Financial Statements & Other Info More information about Annual Financial Statements & Other Info Items 7-11 of Form N-CSR |

| Document |

|---|

| Semi-Annual Report - Class A |

| Semi-Annual Report - Class C |

| Semi-Annual Report - Class Y |

| Semi-Annual Financial Statements & Other Info More information about Semi-Annual Financial Statements & Other Info Items 7-11 of Form N-CSR |

Purchase Details

Open an Account

You can invest with Davis Funds in a number of ways:

- Speak with your Financial Advisor

- Open an account by mail by downloading the applications below

| Document |

|---|

| Application for Individuals (Joint, Trust, Custodial) |

| Application for Businesses |

|

Application for Individual Retirement Account (IRA)

Please download one of the following disclosure and custodial agreements: |

|

Application for Coverdell Education Savings Account

Please download the Coverdell Education Savings Account Disclosure and Custodial Agreement |

Account Minimums

| Investment | Class A | Class C | Class Y |

|---|---|---|---|

| Minimum Initial Investment | $1,000 | $1,000 | $5,000,000 |

| Minimum Additional Investment | $25 | $25 | $25 |

Distributions

2024 Distributions as of 02/11/25

This information on 2024 distributions is intended for existing shareholders

As large shareholders ourselves, we are conscious of tax costs and make every effort to be tax efficient.

Capital gains result from appreciation in the portfolio. The funds' long-term investment approach means that this appreciation may have occurred over an extended period of time. The majority of the gains are long-term and generally subject to lower tax rates than short-term gains or dividend income.

| Share Class | Record Date | Ex-Date | Payable Date | Qualified Dividend Percentage | Ordinary Income | Return of Capital | Short-term Capital Gain | Long-term Capital Gain | Reinvestment Price |

|---|---|---|---|---|---|---|---|---|---|

| Class A | 12/12/24 | 12/13/24 | 12/16/24 | 100% | .417 | - | .045 | 5.84 | 38.47 |

| Class C | 12/12/24 | 12/13/24 | 12/16/24 | 100% | .054 | - | .045 | 5.84 | 25.12 |

| Class Y | 12/12/24 | 12/13/24 | 12/16/24 | 100% | .56 | - | .045 | 5.84 | 41.86 |

Shareholders should not use this information for tax reporting purposes. Form 1099 will be sent at a later date for all tax reporting.

The table above includes the percentage of 2024 dividend and net short-term capital gain distributions, by fund, that are eligible for reduced tax rates as "qualified dividend income" (QDI). QDI-eligible amounts, including any net short-term capital gains, are reported to shareholders in Box 1b of Form 1099-DIV. For those shareholders who do not receive a Form 1099-DIV, QDI-eligible amounts can be determined by applying the relevant percentages from the table to the dividend and net short-term capital gain distributions shown on the shareholder's 2024 year-end account statement. Individual questions should be referred to your tax advisor.

Carefully consider the fund's investment objectives, strategies, risks, charges and expenses before investing or sending money. The prospectus contains this and other information and can be obtained by clicking here.

Before investing in the Davis Funds, you should carefully consider the investment objectives, risks, charges, and expenses of the Funds. The prospectus and summary prospectus contains this and other information about the Funds. You can obtain performance information and a current prospectus and summary prospectus by visiting davisfunds.com or calling 800.279.0279. Please read the prospectus or summary prospectus carefully before investing or sending money. Investing involves risks including possible loss of principal.