We believe that select Banks may be among the best opportunities in the market today, as investors significantly overestimate the risks and underestimate the upside potential of these durable businesses

Related Videos

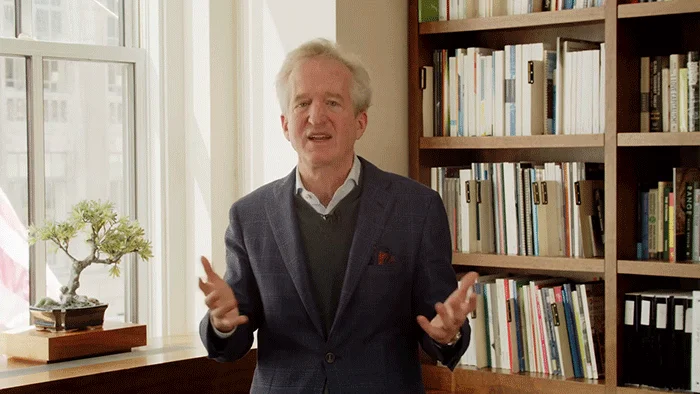

PM Chris Davis with David Rubenstein of Carlyle Group

Why all true investing is value investing, the importance of patience, resisting momentum-driven markets, maintaining discipline through volatility.

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Share this Video

The current average annual total returns for Davis New York Venture Fund’s Class A shares including a maximum 4.75% sales charge can be found here. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, visit davisfunds.com or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.89%. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary.