Navigating Turbulent Markets:

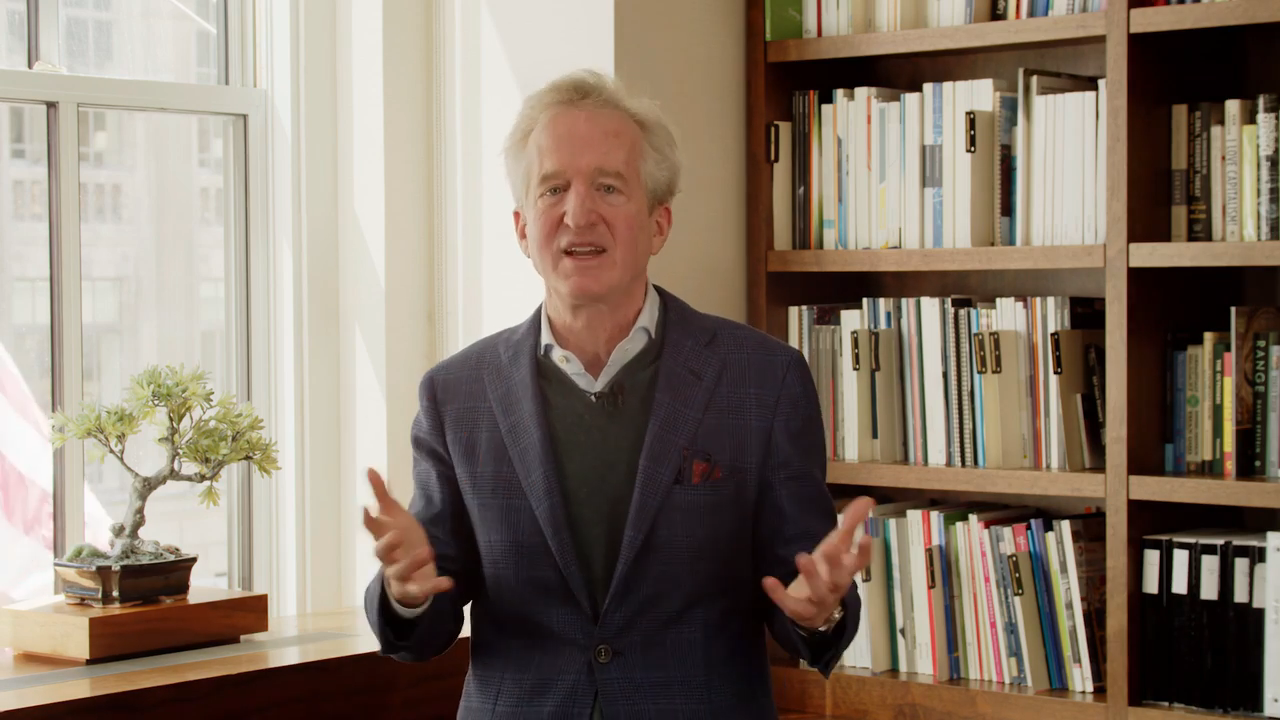

Chris Davis and Bill Miller

Chris and legendary PM Bill Miller discuss some of the most important issues facing investors today.

Nine short clips covering topics from tariffs and geopolitics to A.I., going against the crowd and the danger of cash.

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

“The stock market is a device to transfer money from the ‘impatient’ to the ‘patient’.”

Warren Buffett, Chairman, Berkshire Hathaway

Mastering the Mental Game of Investing

A video series with Chris Davis and Morgan Housel on developing the mindset of a successful investor.

Watch the SeriesThe Wisdom of Great Investors

History’s greatest investors share some of their best advice on building wealth

News & Press

-

DNYV B - Closure & Conversion Details

Accelerated Conversion of all Davis NY Venture Fund B Shares into A Shares; Closure of all Davis NY Venture Fund B Shares

- 2025 Semi-Annual Distributions have been posted.

- Podcast – Bloomberg interviews PM Chris Davis: Investing in a high-multiple, concentrated market

- Two Davis Funds Renamed

-

Video: You Make Most of Your Money in a Bear Market – You Just Don’t Realize it at the Time (7:14)

Historically, market corrections have ultimately been followed by new highs. This is why we believe the savvy long-term investor views a correction as an opportunity to buy stocks at lower prices.

-

Infographic: Equities Have Built Wealth Despite Crises

“History provides crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.” - Shelby M.C. Davis

Ways to Invest

Our Mission

For more than half a century, helping investors reach their financial goals through rigorous research, uncommon stewardship and long term results.

Funds, Factsheets and Commentaries

| Mutual Fund | Factsheet | Portfolio Manager Commentary |

|---|---|---|

| New York Venture Fund | ||

| International Fund | ||

| Global Fund | ||

| Financial Fund | ||

| Opportunity Fund | ||

| Balanced Fund (formerly Appreciation and Income Fund) | ||

| Real Estate Fund | ||

| Government Bond Fund | ||

| Government Money Market Fund |