New Video Interview with Barron’s and Chris Davis

What types of stocks to own during this period of market and economic transition, high valuations and investor complacency.

New: Davis NY Venture Fund PM Commentary

- A market in transition, from the end of the “easy money” bubble, to AI-driven technological change

- A market highly concentrated among richly valued tech names

- A market that may be particularly well-suited to our discipline focused on durable growth, strong fundamentals and discounted valuations

The Most Important Things We Believe Equity Investors Should Focus on Today (6:18)

Why we believe selectivity is more important in a time of great market and economic transition and highs in both market concentration and valuations

Rigorous Research & Selectivity are Critical in Today’s Market (2:14)

Why we’re focused intently on identifying resilient companies with above average growth prospects - and not overpaying

Investment Themes in the Portfolio Today (1:53)

Why we see tailwinds and opportunities across Financials, Tech, Healthcare and Industrials

Barron's Interview with PM Chris Davis: Real Value to be Found Between the Extremes

Chris on an equity environment of “cheap but fragile” at one end, and “high growth but overvalued” on the other. Our target: Durable, growing but undervalued

Mastering the Mental Game of Investing

A video series with Chris Davis and Morgan Housel on developing the mindset of a successful investor.

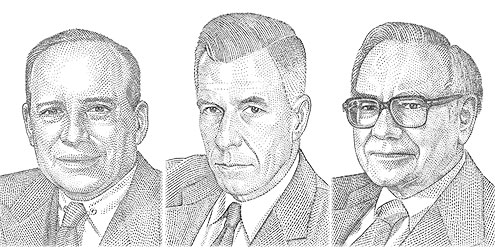

Watch the SeriesThe Wisdom of Great Investors

History’s greatest investors share some of their best advice on building wealth

News & Press

- 2024 Year-End Distributions have been posted.

- Podcast – Bloomberg interviews PM Chris Davis: Investing in a high-multiple, concentrated market

- Two Davis Funds Renamed

-

Video: You Make Most of Your Money in a Bear Market – You Just Don’t Realize it at the Time (7:14)

Historically, market corrections have ultimately been followed by new highs. This is why we believe the savvy long-term investor views a correction as an opportunity to buy stocks at lower prices.

-

Infographic: Equities Have Built Wealth Despite Crises

“History provides crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.” - Shelby M.C. Davis

Ways to Invest

Our Mission

For more than half a century, helping investors reach their financial goals through rigorous research, uncommon stewardship and long term results.

Funds, Factsheets and Commentaries

| Mutual Fund | Factsheet | Portfolio Manager Commentary |

|---|---|---|

| New York Venture Fund | ||

| International Fund | ||

| Global Fund | ||

| Financial Fund | ||

| Opportunity Fund | ||

| Balanced Fund (formerly Appreciation and Income Fund) | ||

| Real Estate Fund | ||

| Government Bond Fund | ||

| Government Money Market Fund |