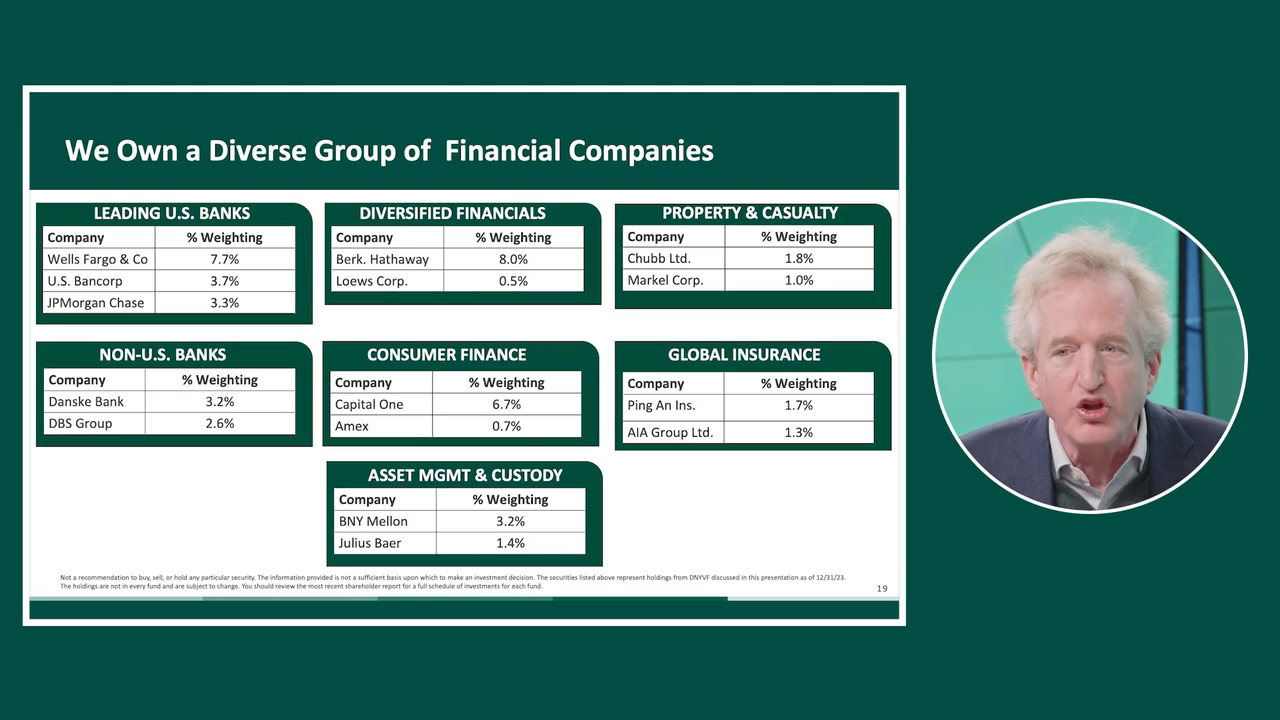

European banks often have different industry dynamics than U.S. competitors, are often the market leaders of financially-responsible countries, have high dividend yields and attractive multiples

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Danton Goei: | We definitely saw that here with the US regional banks, a lot of stress bank runs the Fed having to intervene. And in Europe we haven't seen a similar dynamic. Now the dynamics are very different there. You don't have different classes of banks like here with the large and the smaller banks with different regulations. There, they don't have as big of a differential over there. And also if you look at a country, say Denmark, and you invest in a bank like Danske bank, it's the leading bank there by far. And if there's going to be some worries, they're not going to be leaving a Danske bank to go elsewhere, they're going to be the one that's going to be getting all the assets if there was an issue. But there hasn't been any the same concerns over there. So when we're looking at the European financials, we're looking for the leading bank in some really well run economies, so Denmark or like in Norway with DNB also similarly, market leading position, supported by the government. And these banks are trading at very attractive valuations, about seven, eight times earnings with dividend yields from six to 7% a year. So really, because if you have a 13% earnings yield, you can afford to give out half of that in dividends and you've got a 7% dividend yield. And so those are really attractive, starting point in terms of the multiple starting point in terms of obviously the dividend yield and then also just the safety that you have in these banks. Or a bank like Julius Baer that's slightly different. It's a private wealth manager, but it's one of the premier private wealth managers out there. And you're talking about the assumption of Credit Suisse by UBS that actually over time should benefit Julius Baer. It's just less competition in the private banking both in Switzerland and then globally as well. And so they've actually been growing the number of relationship managers and being able to choose some of the best relation managers out there now that they're available and grow their business that way. And that can have a lag, a one or two year lag before that really grows their book. But over time, those experience relationship managers are able to attract business to the bank. So I think a company like Julius Baer is also really attractive. They're trading about a 10 times multiples, also attractive starting multiple for what should be a decent growth business over time, which is basically global wealth management over time. So I think if you're very selective in some of the financials in Europe, you can find some real gems. |

Related Videos

Undervalued & Underappreciated – The Opportunity Today in Select Financials (4:05)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Opportunities in Financials

We’re focusing on several categories across this underappreciated sector, with durable business models and low valuations