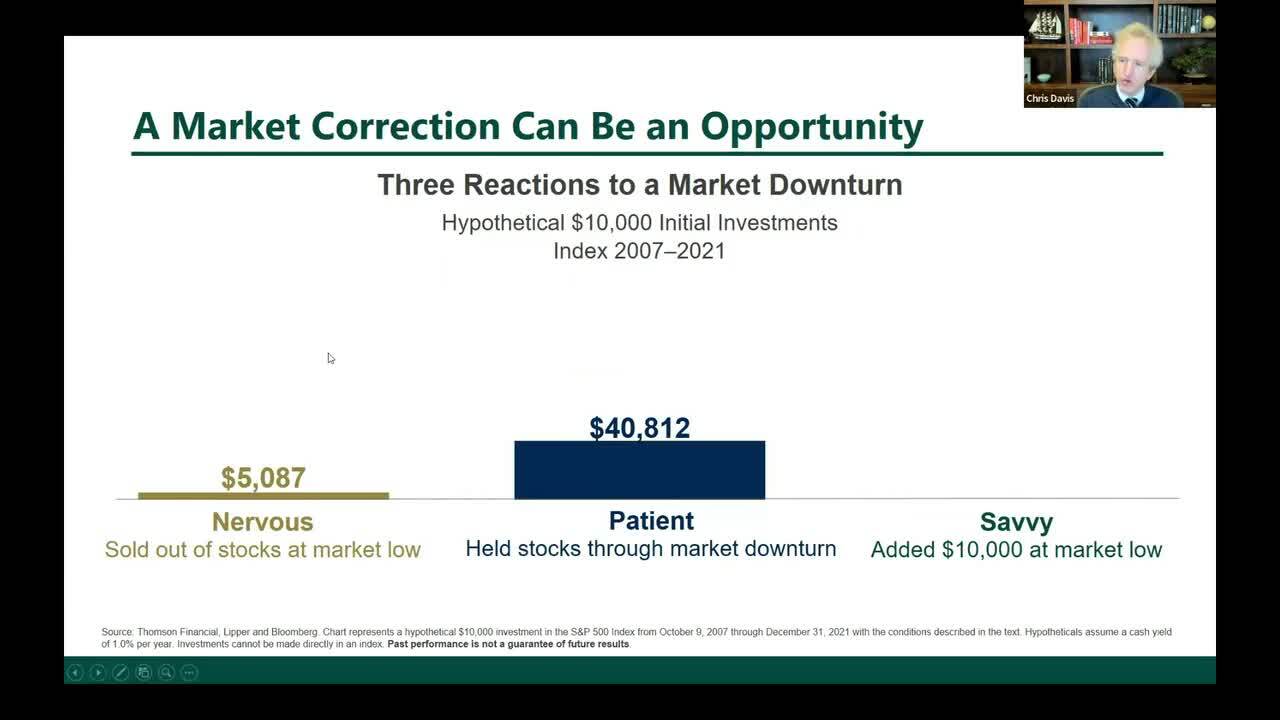

To benefit from the wealth-building potential of equities, investors need to understand that pullbacks and drama will be an inevitable part of the journey.

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis: | We talked about Morgan Housel, Dave. And I'd like to end with a perception of his, an observation of his that's really helpful, which is, that volatility is the price of admissions, to be able to earn excess returns over a long period of time. If we were afraid, if you didn't want to take volatility, then you would sit in the risk-free rate. And as they say, as interest rates rise, you could have a lot of vulnerability as the purchasing power of a dollar falls. And so our view is that volatility in essence, the ability to go through these periods is the admissions price to be in this, to be able to participate in the wealth building nature of owning businesses versus being a creditor. And we think that the world and the uncertainty that we're in is a return to normalcy and it's going to be a period of real adjustment. We've been saying that for a few years. We're in it now. We think we're well prepared. And as I say, what we're seeing in the data is that many of our holdings have been indirectly beneficiaries of this and are seeing their competitive advantages growing. And that's true within the financial sector. And of course, it's more broadly true as we look across the portfolio at all of the companies that we own. That idea of being durable, being resilient, not overpaying, valuing, near-term cash flow as well as long-term competitive advantage. We think those are the ways to navigate uncertain times. And volatility is simply the price of admission. |

Related Videos

Video

Strategies to Mitigate the Investor Behavior Penalty (3:40)

The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

Video

The Incredible Value Advisors Can Add During Volatile Markets

How the guidance of a financial advisor can help investors successfully build wealth as they navigate inevitable market volatility.

Share this Video

Click here for current fund holdings: DFF