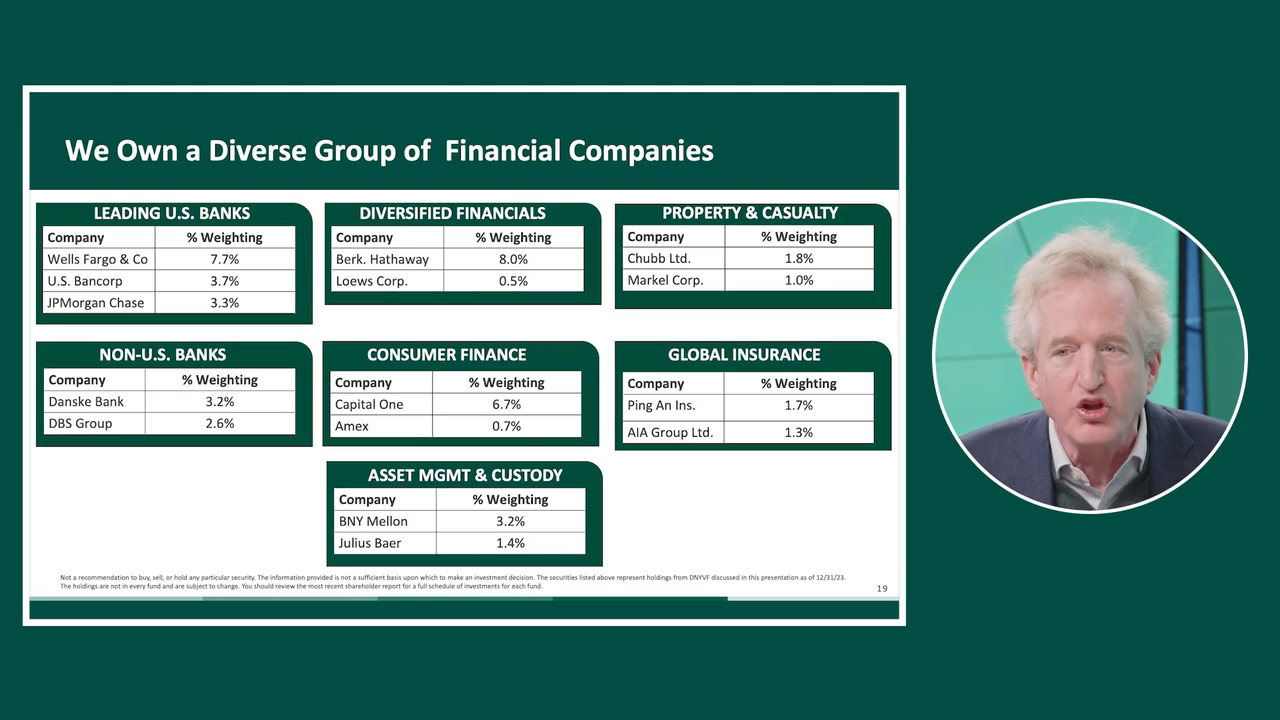

Why we believe select banks are attractive, given their durability, long-term growth, competitive advantages, growing market share and attractive valuations.

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis: | Now I'm going to turn to the meat of the subject at hand, which is, so why own banks at all? And in particular, why own the five banks that you own in our large cap portfolios? Why own banks at all? Now, before I talk about the characteristics of the banks that we own, before we take a look at each one of the major holdings, I'm going to zoom up and just remind you that we don't own banks as a matter of stubborn interest in a single sector. We own banks as a byproduct of our more general investment discipline. So when you think of our long-term investment discipline, especially in an uncertain world, what do we want to own? We want to own durable business models. Within those durable business models, we want to own companies that have competitive advantages, that have wide moats, that have long-term growth, growing market share, and low valuations. Now that is true whether we're looking at a technology company, in fact, I'm just back from a trip to the West Coast and Silicon Valley Bank happened to be on the agenda. It was amazing at the Morgan Stanley conference a couple of weeks ago, there wasn't a single question to Silicon Valley Bank about interest rates and deposits. It was all about the health of the venture capital ecosystem. Shows you how quickly these things can change. So when you think about whether we're looking at a high quality company like Applied Materials, or we're looking at a bank, we're looking at the lens of durable businesses with proven competitive advantages with widening moats where management matters with long-term growth and low valuations. |

Related Videos

Undervalued & Underappreciated – The Opportunity Today in Select Financials (4:05)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Opportunities in Financials

We’re focusing on several categories across this underappreciated sector, with durable business models and low valuations