Tech, Semis, Financials and other themes we expect to drive returns

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

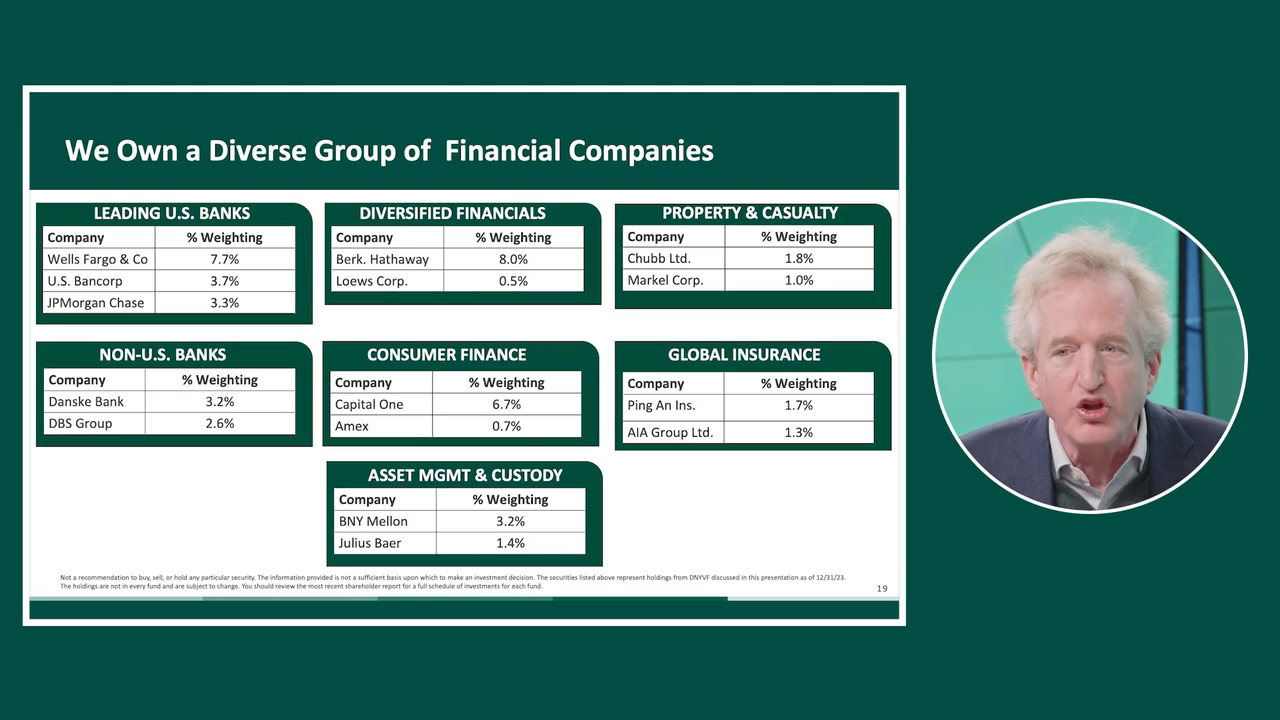

| Chris Davis: | We’re not thematic investors, but if you just wanted to think of broad categories where we're finding this powerful opportunity of durable resilient growth at these enormous valuation discounts. Healthcare, our focus is on value creators versus price takers. You can think of companies like Cigna that Danton mentioned, Viatris, Quest, so on. In industrials, we like resilient, non-linear growth. So in other words, while people overpay for a stock they could put a ruler on, we would much prefer a lumpier growth rate that may have some exposure, economic exposure, but really is proven resilient. You see some of the examples here of what we mean when we say resilient, but non-linear growth. Doesn't matter if they have down earnings one year out of five or two years out of 10. Workhorse technology, people talk about technology as if it's monolithic. We think of the picks and shovels of the new economy. The companies that are making the chips for the tech darlings like Nvidia, those companies could not exist without Applied Materials and buying a company that important at a low multiple. We give some example of that later, Texas, Samsung. Online platforms. We think of these as the Blue Chips of this new next decade or two. Our focus is on the stalwarts, not the darlings, not the hyper growers, but the ones that have proven durability, resilience. They really are the Blue Chips of the next era. And then financials. I'm going to give you a little bit of a better look at financials later as we get to a company example. But our focus in financials is, of course, we always normalize for interest. That's why we avoided a lot of the nonsense about some of these crazy regional banks that were taking crazy interest rate risk. We normalize for interest rates, so that made it easy to avoid those. And of course, we normalize for credit. We know there'll be a recession during our holding period. We know that there'll be periods of rising reserves and falling reserves, so we put those in. And you can see exactly the sorts of companies that we own and you can get a sense of their durability and their resilience even through this period that we've gone through with the mini crisis earlier this spring. |

Related Videos

Undervalued & Underappreciated – The Opportunity Today in Select Financials (4:05)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Opportunities in Financials

We’re focusing on several categories across this underappreciated sector, with durable business models and low valuations

Share this Video

Click here for current fund holdings: DNYVF