Manager

Share

Key Takeaways

- Davis International Fund (DIF) posted a return of +21.58% in 2024, substantially outperforming its MSCI ACWI (All Country World Index) ex US benchmark.

- We believe China may be starting to emerge from its long economic slump following the government’s more aggressive stimulus measures in late-2024. Retail sales are improving, property prices appear to be stabilizing and GDP growth has strengthened.

- As we position the portfolio for the emergence of AI, we find opportunity among established market leaders with proven business models that are either using AI to improve a large existing platform or are key semiconductor players helping to build out the AI ecosystem.

- While high market valuations remain a key investment risk, our portfolio has been built to emphasize durability and resilience. We focus on competitively advantaged companies with strong managements trading at attractive valuations that can be expected to produce good results through shifting economic conditions.

The average annual total returns for Davis International Fund’s Class A shares for periods ending June 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 23.97%; 5 years, 4.40%; and 10 years, 4.22%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, click here or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 1.17%.The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses of Class A shares at 1.05%. The expense cap expires March 1, 2026. For purposes of this expense cap, operating expenses do not include foreign tax reclaim filing expenses. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. All fund performance discussed within this material refers to Class A shares without a sales charge and are as of 12/31/24, unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. The Attractive Growth and Undervalued reference in this material relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Performance

Davis International Fund (DIF) posted a strong return of +21.58% in the year ended December 31, 2024, substantially outperforming the +5.53% return of the MSCI ACWI ex US. In this report, we discuss factors that contributed to the fund’s good performance, along with any underperformers during the same period.

Contributors to Performance

DIF’s holdings in Chinese consumer-facing companies were major contributors to the fund’s 2024 outperformance. Meituan was the largest contributor—its shares rose 86% over the year. This leader in food delivery is enjoying strong growth in its core local commerce business while maintaining good cost discipline. In the third quarter of 2024 revenues in this segment were up 22% while operating profits grew 44%. Meituan has competitive advantages in both its food delivery business, where it has taken share from Alibaba’s ele.me, and its in-store business, where it has successfully fended off an incursion from Bytedance.

We invested in Trip.com, the largest online travel agency in China, in the third quarter of 2024 and its shares rose 66% by year-end. The Chinese continue to show a strong desire to travel both domestically and abroad. In the third quarter of 2024 Trip.com’s revenues were up 16% and operating profits were up 28%.

Naspers and Prosus shares returned 30% and 34%, respectively, in 2024, driven by their 24% ownership of Tencent. Tencent is the world’s largest video game company and the messaging and social media leader in China. Revenues in Tencent’s video game and advertising sales segment grew 8% in the third quarter of 2024 and earnings were up 18%, pushing operating margin to over 30%.

Ping An Insurance Group returned 41% in 2024 due to strong growth in the life insurance business. China’s second largest life insurer has successfully completed its multi-year salesforce reform, shrinking the number of sales agents from 1.4 million in 2018 to 362,000 in September 2024, and generating sales agent productivity gains. The company continues to retain a strong presence in the retail market with 240 million retail customers driving 90% of the firm’s profits. Ping An remains attractively valued at 5x owner earnings with a 6% dividend yield.

Sea Ltd., Southeast Asia’s e-commerce leader, returned 65% in 2024 after we first invested in May 2024. Both the e-commerce and lending businesses grew, contributing to revenue growth of 31% in the third quarter of 2024. Coupang, the e-commerce leader in South Korea, was up 36% in 2024, driven by continued market share gains.

Detractors from Performance

Samsung was the biggest detractor from results in 2024 as its shares fell 39% over the year. Investors were expecting a rebound in 2024 after a cyclical decline in 2023 but weakness in Samsung’s traditional memory markets and an inability to get qualified in high bandwidth memory (HBM) for AI chips by Nvidia led to some disappointing results. On the other hand, we expect Samsung to finally work with Nvidia in 2025 and grow its share in HBM from 40% to about 50%, regaining leadership in the sector from Korean semiconductor company SK Hynix. Samsung was trading at only 7x estimated 2025 owner earnings in January 2025. We believe its strong memory chip market position and solid second-place ranking in the semiconductor foundry business is dramatically undervalued.

AIA Group, the Hong Kong-based pan-Asian life insurer, declined 14% in 2024 as macroeconomic weakness in China led to reduced sales of critical illness products and lower investment returns. At year-end 2024, long-term government bond yields in China were down to 1.7% from 2.6% at the start of 2024, hurting investment returns.1 Sales were up 17% in the first half of 2024 despite economic weakness. As the macro outlook improves we expect new policy sales and improved investment returns will grow further. Trading at only 8x 2025 owner earnings in January 2025, AIA is attractive.

Market Perspectives:

No Letup in Valuation Risk

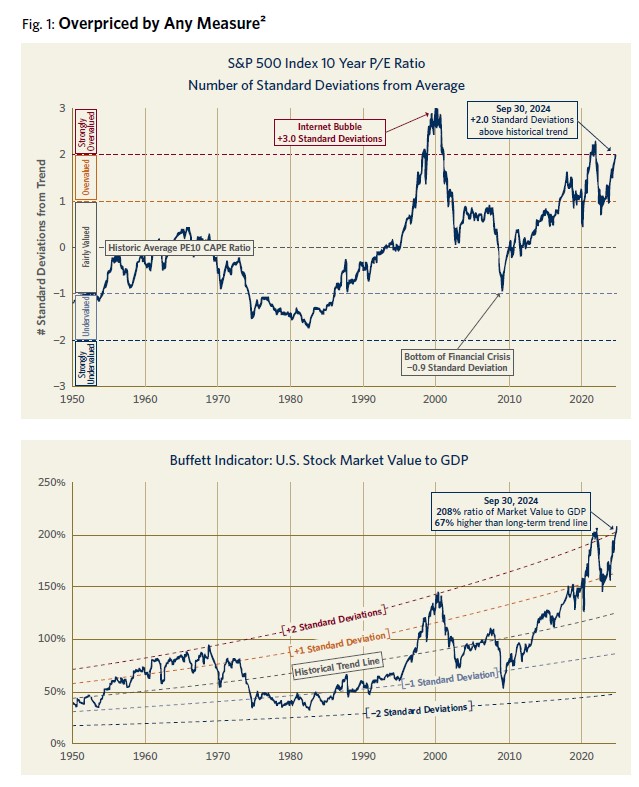

High stock market valuations continue to be a major risk facing investors today. As seen in Figure 1, the price/earnings (P/E) ratio of the S&P 500 Index was around two standard deviations above its historic average towards the end of 2024. At the same time, U.S. stock market value as a percentage of total U.S. gross domestic product—the so-called Buffett Indicator—was near its highest level in history.

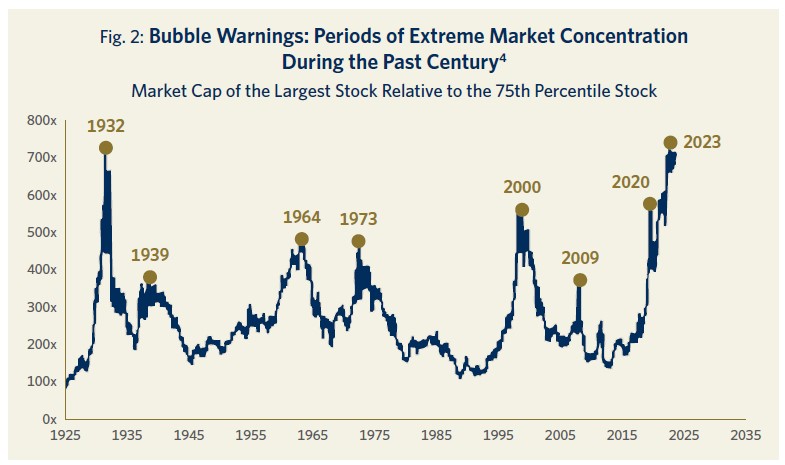

A key driver of high market valuations is the extreme level of concentration in a few large highly valued companies. By some measures, the market is at its highest level of concentration in the past century. In the past, such concentration has tended to be a warning sign of a stock market bubble (see Figure 2).

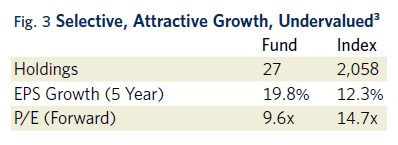

By selectively investing in competitively advantaged companies run by experienced and talented managers, and purchasing these companies at attractive valuations, Davis Advisors has consistently grown wealth for its investors since its founding over five decades ago. In the case of DIF, these timeless investment principles have resulted in a portfolio that has average earnings growth in excess of its MSCI ACWI ex US benchmark alongside an average P/E valuation well below the benchmark (see Figure 3). We believe this selective portfolio of high quality companies trading at low valuations bodes well for future returns.

China:

Stimulus Takes Hold

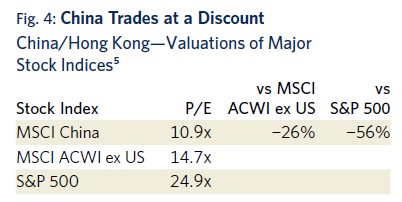

One opportunity for global investors today is to take advantage of lower valuations amongst international companies. China’s valuation discounts are among the largest. In December 2024, the MSCI China Index was trading at a 26% P/E discount to the MSCI ACWI ex US and a 56% P/E discount to the S&P 500 Index (see Figure 4). However, many of these Chinese companies are high-quality, profitable and well-run businesses with strong growth outlooks operating in the world’s second largest economy. Over the past 2–3 years Chinese companies have also been returning significant amounts of cash to shareholders via dividends and share repurchases.

The ability of the Chinese economy to reach the government’s stated goal of achieving GDP growth of “about 5%” was in question for much of 2024. However, in September 2024 the central government announced a major economic support package. To bolster the property market, the People’s Bank of China (PBOC), China’s central bank, cut the mortgage rate by 0.5% and lowered the minimum down payment on second homes from 25% to 15%, matching the already lowered level for first-time home purchases.

The central bank further announced it would fund a RMB 300 billion loan initiative to allow state-owned enterprises to buy unsold properties and turn them into affordable housing units. It also cut a key short-term lending rate and reduced the reserve requirement ratio for commercial banks, thereby releasing an additional RMB 1 trillion ($140 billion) of long-term liquidity into China’s financial markets.

China’s government additionally showed it was focused on supporting the stock market by establishing a RMB 500 billion ($70 billion) lending facility to financial firms to buy stocks. An additional RMB 300 billion ($40 billion) will be lent to corporations to repurchase their own shares.6

Two days after the PBOC announced these measures, the Politburo demonstrated that it saw the need for rapid and meaningful economic stimulation by moving an important economic meeting originally scheduled for December 2024 up to September. In this special meeting the Politburo announced the issuance of RMB 2 trillion of sovereign bonds to support consumption and help local governments tackle their debt challenges. Measures to boost consumption included help for enterprises to upgrade large-scale business equipment and the provision of a monthly allowance of RMB 800 billion ($114) per child to households with two or more children.7 Later, in December 2024, the government followed up by announcing that it would increase the sovereign bond issuance to RMB 3 trillion ($411 billion), and would include funding to companies investing in advanced innovation-driven economic sectors.8

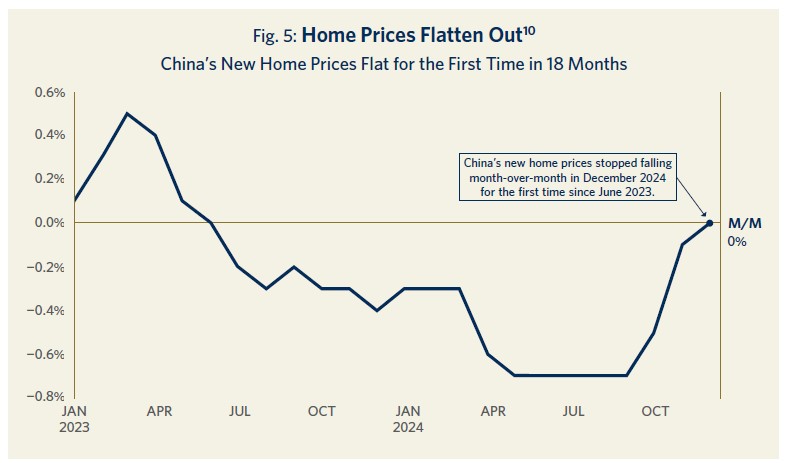

It is still early days and many of the details of the announced economic stimulus programs will have to wait for the annual parliamentary meetings in early March, known as the “two sessions.” However, the stimulus programs are already having a positive impact. China’s annualized GDP growth in the fourth quarter of 2024 was a strong 5.4%, pushing the growth rate for the full year to 5.0%. Importantly, the property market seems to be stabilizing. Developers sold 4% more residential floor space in December than the year before, the second monthly increase in a row.9 Real estate prices also seemed to be stabilizing. Price declines started narrowing in October and November 2024, and in December, for the first time in 18 months, prices were flat month-over-month (see Figure 5).

Retail sales, while still relatively sluggish, have started to improve as well, averaging 3.8% year-over-year growth in the fourth quarter of 2024 compared to 2.7% growth in the third quarter.11 Should Chinese consumers regain confidence that the real estate market has stabilized and that economic growth will remain on track, their high propensity to save gives them pent-up spending power which could lead to strong consumption growth. The net increase in savings as shown by household bank deposits since 2020 has been over $9 trillion which is more than all China retail sales in 2023.12

The companies we visited on a trip to China in December 2024 were optimistic about the government’s economic stimulus efforts. One reason was that the Politburo, chaired by President Xi, is being very vocal in its support for the stimulus plan. The central government has the balance sheet to support a major stimulus plan and President Xi has the ability to craft and implement it. The fact that it was the Politburo that enacted the September stimulus was seen as increasing the odds it would be effective and large enough to be successful. Early in 2025 the government continued to announce measures to support growth and the domestic stock market. On January 22, the China Securities Regulatory Commission (CSRC) and the PBOC announced that state insurers will have to invest a minimum of 30% of their new policy premiums in local shares while mutual funds need to increase their local shareholdings by 10% annually for the next three years. Estimates are that the additional flows into the equity market could total RMB 470–530 billion ($65–74 billion) in 2025 alone.13

Despite the “green shoots” seen in the fourth quarter of 2024, the Chinese economy faces a number of challenges. Near-term challenges include the threat of higher tariffs on Chinese exports to the U.S. China’s exports to the world grew approximately 13% to nearly $1 trillion in 2024, a major reason why the country achieved 5% GDP growth that year. Exports accounted for an estimated 20% of GDP in 2024.14 The U.S. remains China’s largest trading partner but its share of China’s exports had fallen to 15% in 2023 from 19% in 201815 and exports to the U.S. account for only 3% of China’s GDP. China will possibly be able to replace any decline in exports to the U.S. with sales to other countries. Even if it cannot, the impact on its economy will likely be manageable. The consumer-focused stimulus plans will be important in offsetting any possible exports weakness in 2025.

A longer-term challenge is how to address local government debt problems, which is the purpose of the announced RMB 1 trillion sovereign bond issuance. Aging demographics are also a concern. China’s overall population growth has declined at a rate of -0.03% per year over the last five years. Urban population, however, is still growing, rising 1.3% per year over the past five years as the one-third of the population still living in rural areas migrates to the cities.16 Urban residents are the key consumers and employees for our portfolio companies. Over the next decade, China’s total population is forecast to remain largely flat although aging will likely lead to a slowly declining workforce.17 Urbanization, a rise in the currently low retirement age, and increased automation are some of the factors that could help offset the impact of the aging population.

Positioning the Portfolio for AI

It has been more than two years since the public launch of OpenAI’s ChatGPT in November 2022, but excitement around generative AI (GenAI) remains pervasive among the management teams we engage with and in the broader markets. Investment in GenAI—and AI more broadly—continues to accelerate, benefiting key technology suppliers in the AI tech stack, such as GPU-maker Nvidia. On the applications side, progress is evident with GenAI-first apps like ChatGPT achieving ever-wider adoption (by December 2024, 300 million ChatGPT weekly users were sending over one billion messages per day).18 GenAI features are proliferating across the largest consumer platforms, including Google Search, Instagram and Amazon.

The pace of AI innovation remains rapid. Over the past year several new companies have demonstrated the ability to build frontier-level large language models (LLMs), raising questions about the long-term competitive moat around LLM development. Simultaneously, debates have emerged about whether advancements in LLM training are reaching a plateau. We have also seen how innovations in inference computing are driving impressive improvements in LLM reasoning capabilities. We believe the fast-evolving nature of this industry reinforces the importance of being patient and selective in identifying, and building conviction in, businesses that could generate the long-term profits needed to justify their current valuations.

Tencent (owned via our investments in Naspers and Prosus) is another company we continue to favor in the application layer. Tencent’s profitable and growing social media, messaging and video gaming businesses all stand to benefit from AI. Within its social media platforms, we expect Tencent to see meaningful gains from AI-driven ranking and recommendation improvements, particularly in Video Accounts, the short-form video product that has become a core use case within WeChat. We expect a long runway for Tencent’s GenAI capabilities to improve ad creative and performance, and increased monetization over time. Tencent’s massive distribution advantage through WeChat positions it well for any breakthrough GenAI products. For instance, in search, which is doubling revenues year-over-year, Tencent is already finding success in leveraging GenAI technology to capture significant market share.

We see investment opportunities in some of the workhorse technologies that could flatten the trajectory of this steep incline in power consumption. One area that we believe remains attractive is semiconductor memory, traditional DRAM but particularly high-bandwidth memory or HBM. AI workloads cannot run on conventional memory because the transfer rate (or bandwidth) is too slow. Compared to standard DRAM, HBM has a 10x faster transfer rate because these memory chips along with the logic tiles (GPU, CPU, TPU, etc.) are physically connected to a larger silicon die (interposer).

These multi-chip systems provided one of the key breakthroughs that enabled LLM training and agentic computing in the first place. Their deployment—which extends beyond AI datacenters—significantly reduces power consumption, improves performance and reduces the server footprint. HBM features a much shorter data path between the host processor and memory which significantly reduces latency and the amount of time the server requires to complete each task. A denser server footprint lowers the significant cost of cooling the servers. Completing the same tasks with fewer, densely packed servers and being able to run larger workloads in each datacenter reduces the power that each processing task requires. The economics of datacenters boils down to data throughput per watt and the 10x faster transfer rate of HBM has been a game-changer.

Those wanting to compete in the emerging HBM market face higher barriers to entry than in the overall memory market because these memory chips must be qualified by the company that designed the logic chip (Nvidia, AWS, Google, Intel, AMD, etc.). Each HBM customer has specific performance and power consumption requirements unlike anything we’ve seen before in the memory market. Today the marquee account in HBM is Nvidia and its primary supplier is SK Hynix. However, we anticipate that the market leader in memory, Samsung, will qualify as a second supplier to Nvidia in 2025. Samsung was trading at just 7x estimated 2025 owner earnings per share in January 2025. We see its risk-reward profile as very favorable given that the company is among the global leaders in essential AI technologies like HBM (40% market share) as well as providing semiconductor foundry and advanced chip packaging services for third-party fabless chip companies (16% market share).

We continue to find attractive established market leaders in technology with proven business models that are able to take advantage of the opportunities in AI. These are either using AI to improve a large established platform, such as Tencent, or are key players in the semiconductor space helping to build out the AI ecosystem, such as Samsung. All have very profitable businesses that are further enhanced by advancements in AI.

Portfolio Holdings

Trip.com

Founded in 1999 and publicly listed in 2003, Trip.com owns the leading online travel agency (OTA) brands in China, Ctrip and Qunar, in addition to two key international travel businesses, Dublin-based Skyscanner and Singapore-based Trip.com. The company also owns just under 50% of publicly listed MakeMyTrip, India’s largest OTA. Through the company’s various platforms, business and leisure travelers can search and book all types of travel-related services, including flights, trains, hotels, car rentals, packaged tours, etc. With strong brand recognition, especially among consumers in China’s Tier 1 and Tier 2 cities, comprehensive selection, and a reputation for excellent customer service, the company’s core domestic brand Ctrip has established itself as the go-to travel platform for China’s rapidly growing number of travelers.

Trip.com makes money by taking a commission from each transaction booked on its platform. Accommodation reservations make up 40%+ of total revenues and an even greater share of profits. The accommodations industry in China is particularly attractive given its relatively low online penetration rate and low hotel chain penetration. Transportation ticketing accounts for 38% of revenues but has meaningfully lower profitability and is primarily used as low-cost customer acquisition for the rest of the platform. Trip.com has a robust outlook in domestic travel but we are also excited about its long-term growth prospects in China’s outbound travel market (Chinese citizens traveling abroad) and its fast-growing international business, primarily focused on Asian markets outside of China. In aggregate, the portion of Trip.com’s businesses touching international markets already accounts for approximately 35% of revenues and is poised to grow rapidly over the next few years.

Although shares have appreciated meaningfully since we bought Trip.com, we believe that valuation is still reasonable at 24x 2025 and 20x 2026 owner earnings, given the company’s strong competitive position and long runway to compound earnings growth. Key risks include renewed competitive intensity from formidable platform players like Meituan and ByteDance, geopolitical tensions that could reduce outbound travel demand or jeopardize the company’s investments in other jurisdictions (e.g., its stake in MakeMyTrip), and further macroeconomic weakness hurting discretionary travel demand.

Entain Plc

Entain is one of the world’s largest sports betting and gaming groups. It operates in 30 countries and has a leadership position (#1–3 market share) in the five largest regulated markets (U.S., U.K., Australia, Italy, Germany) and the two fastest growing ones (U.S. and Brazil). Its key brands are Ladbrokes, Coral, BetMGM, Bwin, BetCity, Sportingbet and TAB. Some 30% of Entain’s business is retail—corner stores where people place in-person bets. We expect this business to grow by low single digits on an annual basis and achieve a 20% EBITDA margin in time. The remaining 70% of Entain’s business is online. Here we expect annual growth in the high single to low double digits and EBITDA margin close to 30% over time.

Gaming industry revenues had a 13% CAGR in the 12 years from 2011 to 2023, growing to $132 billion annually. Entain expects continued annual growth in the double digits. It also expects that growing scale and operating leverage will lead to rising margins. Entain has had some execution issues and management turnover, however—this in fact allowed us to start our position in the company at an attractive valuation. Entain was trading at an estimated 11x 2025 owner earnings in January 2025. Key risks include adverse regulatory changes in the gaming industry, tough competition in the online space, a possible recession and management turnover.

Outlook:

Durability and Resilience

Davis International Fund’s substantial outperformance in 2024 was driven by our focus on uncovering great businesses trading at attractive valuations. While we still have some performance ground to make up, the portfolio’s faster growth in earnings and substantial valuation discount to the market provide a promising outlook for future returns.

We remain watchful for risks which include the high valuation of certain stocks, inflationary pressures, large government deficits and debt levels, geopolitical volatility and recession threats. However, our portfolio has been built with a focus on durability and resilience. It comprises competitively advantaged companies run by talented and experienced managers and trading at attractive valuations. We expect their strong balance sheets, cash generation power and adaptability to produce good results through shifting economic conditions.

For more than 50 years we have navigated a constantly changing investment landscape guided by one North Star: to grow the value of the funds entrusted to us. We are pleased to have achieved strong results thus far and look forward to the decades ahead. With more than $2 billion of our own money invested in our portfolios, we stand shoulder to shoulder with our clients on this long journey.19 We are grateful for your trust and are well-positioned for the future.

Tradingeconomics.com, “China 10-Year Government Bond Yield” (https://tradingeconomics.com/china/government-bond-yield).

Source: www.currentmarketvaluation.com. The “P/E Ratio” chart uses the cyclically adjusted P/E (CAPE) ratio which takes the average earnings over the last 10 years compared to the current stock market price. The CAPE ratio avoids the problem of a major recession year when earnings decline rapidly, such as by 90% in 2008, when, despite a dramatic decline in the stock market, the P/E ratio using current earnings jumped up to 120x.) The Buffett Indicator is named in honor of Warren Buffett who described it as one of the best long-term indicators of the relative attractiveness of stocks.

Five-year EPS Growth Rate (5-year EPS) is the average annualized earnings per share growth for a company over the past 5 years. The values shown are the weighted average of the 5-year EPS of the stocks in the Fund or Index. Approximately 19.55% of the assets of the Fund are not accounted for in the calculation of 5-year EPS as relevant information on certain companies is not available to the Fund’s data provider. Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Fund’s data provider. These values for both the Fund and the Index are the weighted average of the stocks in the portfolio or Index.

Source:Compustat, CRSP, Kenneth R. French, Goldman Sachs Global Investment Research.

Source: Clearwater Wilshire Atlas.

Caixin Global, “Update: China’s Fresh Stimulus Targets Property and Stock Market Challenges,” 9/24/24 (https://www.caixinglobal.com/2024-09-24/china-rolls-out-fresh-stimulus-to-boost-sluggish-economy-102239313.html).

Reuters, “Exclusive: China to issue $284 billion of sovereign debt this year to help revive economy,” 9/26/24 (https://www.reuters.com/markets/asia/china-issue-284-bln-sovereign-debt-this-year-help-revive-economy-sources-say-2024-09-26/).

Reuters, “Exclusive: China plans record $411 billion special treasury bond issuance next year,” 9/24/24(https://www.reuters.com/world/china/china-plans-411-bln-special-treasury-bond-issuance-next-year-sources-say-2024-12-24/).

The Economist, “China meets its official growth target. Not everyone is convinced,” 1/17/25 (https://www.economist.com/finance-and-economics/2025/01/17/china-meets-its-official-growth-target-not-everyone-is-convinced).

Source: Reuters, based on data from China National Bureau of Statistics (NBS). (https://www.reuters.com/world/china/chinas-new-home-prices-steady-first-time-1-12-years-after-stimulus-push-2025-01-17/).

Trading Economics, “China Retail Sales Indicators” (https://tradingeconomics.com/china/retail-sales-annual).

Statista, “Total retail sales of consumer goods in China from 2013 to 2023,” 12/20/24 (https://www.statista.com/statistics/289168/china-consumer-goods-retail-sales/).

Financial Times, “Beijing tells insurers to buy more Chinese stocks,” 1/23/25 (https://www.ft.com/content/ef2019dd-317b-4d59-863a-50cb21e2373d).

Council on Foreign Relations, “China’s Stunning 2024 Export Growth,” 12/17/24 (https://www.cfr.org/blog/chinas-stunning-2024-export-growth).

Statista, “Urban and rural population of China from 2014 to 2024,” 1/17/25 (https://www.statista.com/statistics/278566/urban-and-rural-population-of-china/).

Economist Intelligence Unit, “China’s demographic outlook and implications for 2035,” 1/30/24 (https://www.eiu.com/n/chinas-demographic-outlook-and-implications-for-2035/).

As of 12/31/24, Davis Advisors, the Davis family and Foundation, our employees, and Fund directors have more than $2 billion invested alongside clients in similarly managed accounts and strategies.

This material is authorized for use by existing shareholders. A current Davis International Fund prospectus must accompany or precede this material if it is distributed to prospective shareholders. You should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. Read the prospectus carefully before you invest or send money.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this material. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

Objective and Risks. The investment objective of Davis International Fund is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Some important risks of an investment in the Fund are: stock market risk: stock markets have periods of rising prices and periods of falling prices, including sharp declines; common stock risk: an adverse event may have a negative impact on a company and could result in a decline in the price of its common stock; foreign country risk: foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified; China risk – generally: investment in Chinese securities may subject the Fund to risks that are specific to China including, but not limited to, general development, level of government involvement, wealth distribution, and structure; headline risk: the Fund may invest in a company when the company becomes the center of controversy. The company’s stock may never recover or may become worthless; depositary receipts risk: depositary receipts involve higher expenses and may trade at a discount (or premium) to the underlying security; foreign currency risk: the change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency; exposure to industry or sector risk: significant exposure to a particular industry or sector may cause the Fund to be more impacted by risks relating to and developments affecting the industry or sector; emerging market risk: securities of issuers in emerging and developing markets may present risks not found in more mature markets. As of 6/30/25, the Fund had approximately 47.8% of net assets invested in emerging markets; large-capitalization companies risk: companies with $10 billion or more in market capitalization generally experience slower rates of growth in earnings per share than do mid- and small-capitalization companies; manager risk: poor security selection may cause the Fund to underperform relevant benchmarks; fees and expenses risk: the Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund; mid- and small-capitalization companies risk: companies with less than $10 billion in market capitalization typically have more limited product lines, markets and financial resources than larger companies, and may trade less frequently and in more limited volume; and shareholder concentration risk: from time to time, a relatively large percentage (over 20%) of the Fund’s shares may be held by related shareholders. A large redemption by one or more of such shareholders may reduce the Fund’s liquidity, may increase the Fund’s transactions and transaction costs, may result in substantial capital gains distributions for shareholders, and may increase the Fund’s ongoing operating expenses, which could negatively impact the remaining shareholders of the Fund. See the prospectus for a complete description of the principal risks.

The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. As of 6/30/25, the top ten holdings of Davis International Fund were: Danske Bank, 8.42%; Prosus, 6.61%; Naspers, 6.16%; Ping An Insurance Group, 6.03%; Meituan, 5.75%; Julius Baer Group, 5.25%; Entain, 5.05%; AIA Group, 4.99%; Samsung Electronics, 4.64%; DiDi Global, 4.39%.

Davis Funds has adopted a Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding information. This policy is described in the statement of additional information. Holding percentages are subject to change. Visit davisfunds.com or call 800-279-0279 for the most current public portfolio holdings information.

The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

We gather our index data from a combination of reputable sources, including, but not limited to, Lipper, Clearwater Wilshire Atlas and index websites.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets throughout the world. The index includes reinvestment of dividends, net foreign withholding taxes. Investments cannot be made directly in an index. The MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g., ADRs). With 756 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization. The S&P 500 Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The index is adjusted for dividends, weighted towards stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in an index.

After 4/30/25, this material must be accompanied by a supplement containing performance data for the most recent quarter end.

Item #4760 12/24 Davis Distributors, LLC, 2949 East Elvira Road, Suite 101, Tucson, AZ 85756, 800-279-0279, davisfunds.com

International Fund

Annual Review 2025

Managers