Managers

Share

Key Takeaways

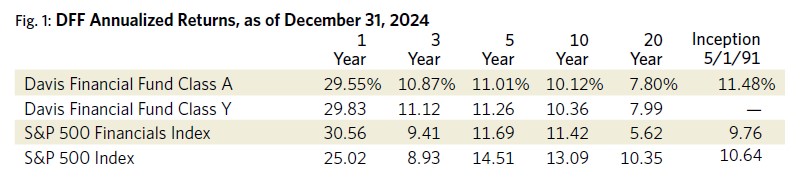

- The S&P 500 Index returned +25.02% for the full year 2024. The S&P Financials Index exceeded the broad index’s performance with a gain of +30.56%. Davis Financial Fund (DFF) returned +29.55% during this period.

- Stock valuations overall have increased given the S&P 500 Index’s strong performance but there remains a significant dispersion among them. This may be most apparent in the valuations of large U.S. technology companies, but is also noticeable within the Financials Index. The companies in Davis Financial Fund are valued in aggregate at a significant discount to the overall market.

- We believe that our portfolio companies are well-positioned to withstand an eventual recessionary environment. Though short-term market fluctuations are unpredictable, our companies’ valuations are sufficiently low that we think they should be able to generate attractive returns over the next decade.

The average annual total returns for Davis Financial Fund’s Class A shares for periods ending June 30, 2025, including a maximum 4.75% sales charge, are: 1 year, 26.77%; 5 years, 20.40%; and 10 years, 10.65%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, click here or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.94%. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. All fund performance discussed within this material refers to Class A shares without a sales charge and are as of 12/31/24 unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Strategy:

Growth in Disguise

Since its inception in 1991, Davis Financial Fund has invested in durable, well-managed financial services companies at value prices, which the fund could hold for the long-term. Shelby Cullom Davis’s quip that financial services companies can be “growth companies in disguise” remains a bedrock tenet of our approach. Investors tend to place low valuations on financial companies because of their earnings volatility. However, many financial companies generate capital through the business cycle at an attractive rate which they use to pay dividends, buy back stock or otherwise deploy in ways that increase shareholder value. By focusing on economic reality rather than investor sentiment, Davis Financial Fund has compounded shareholder wealth at +11.5% annually over nearly 34 years, outpacing both the S&P 500 Index and the S&P 500 Financials Index.

2024 Results:

Second-Half Strength

The S&P 500 Index returned +25.02% for the full year 2024. The breadth of stock market performance improved in the second half of 2024 compared with earlier periods but overall annual performance continued to be heavily driven by the index’s large technology stocks. Nvidia alone contributed greater than 5 percentage points to that result and several of the index’s other large technology holdings also posted strong returns. The “Magnificent 7 plus 1” tech stocks1 now collectively sport a $19 trillion market capitalization, comprise approximately 36% of the S&P 500 Index, and returned in aggregate approximately +51% in 2024. In contrast, the equal-weighted S&P 500 Index increased by only +12.98%. As was the case in 2023, market leadership continues to be heavily concentrated in a handful of large technology companies.

The S&P Financials Index returned a gain of +30.56%, ahead of both the S&P 500 and the equal-weighted index. The Financials Index lagged the S&P 500 through the first half of the year but started to outperform in the latter part of the summer and into the fall, and then spiked up immediately after the U.S. elections in November. The strongest market performance was in large banks (including the investment banks), consumer finance firms, alternative investment managers and financial software companies. Payment networks, financial data providers and exchanges lagged.

Davis Financial Fund returned +29.55 during this period (see Figure 1). The biggest contributors to our relative performance were our large bank holdings (Wells Fargo and JP Morgan Chase), our consumer finance holdings (Capital One and American Express), BNY Mellon and selected international banks (Metro Bank and DBS Group). The fund’s largest detractors were property and casualty insurers (Markel, Chubb, Loews and Everest Group), selected international banks (Danske and DNB), mortgage originator Rocket Companies and Julius Baer.

Market Environment:

Valuation Dispersion

The stock price performance of U.S. markets has been quite strong in each of the last two years. For our financial company holdings we would largely attribute this to the absence of bad news and the waning of the cloud of pessimism that hung over financial stocks at the outset. Over this two-year period we saw annual U.S. GDP growth of 2.9%, an unemployment rate that has edged up but remains low by historical standards at 4.1%, and a rate of inflation that has been reined in from the higher levels seen in 2021–2022 (although remains stubbornly above the Fed’s 2% target). At banks specifically, credit losses are “normalizing” upward but similarly remain at modest levels in aggregate (inclusive of losses taken on commercial office real estate). Deposit balances have stabilized and the spread between deposit costs and market yields remains quite attractive. There is also an improving outlook on pending regulatory capital rule changes. So despite the stress put upon the financial system by the failure of Silicon Valley Bank and others in early 2023, the environment has turned out to be conducive to attractive profitability at banks, insurers and capital markets players generally.

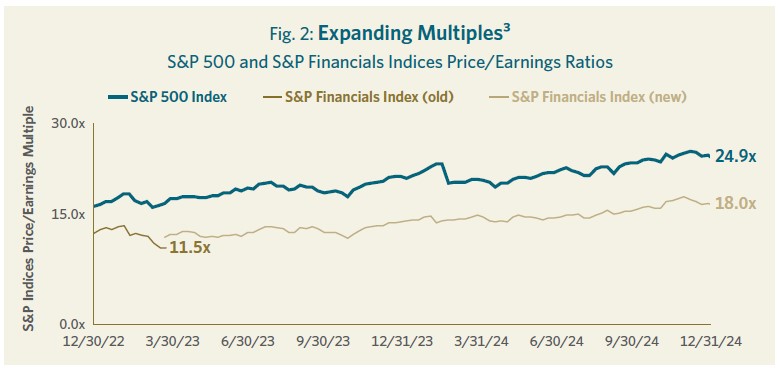

However, stock prices have certainly increased much more than the growth in earnings, resulting in higher valuation multiples for stocks, broadly, and for financial companies as well. As shown in Figure 2, the S&P 500 Index was trading for 24.9x current year earnings at the end of 2024, an increase of approximately seven points since the beginning of 2023. This trend has been heavily influenced by those eight large technology companies which collectively are valued at approximately 36x earnings. However, that would still imply a multiple of roughly 19x for the rest of the S&P 500 Index, which is not low by historical standards.2

The S&P Financials Index was trading at an 18x multiple at year-end (see Figure 2), approximately four points3 above where it was at the start of 2023. In fairness, this was skewed by S&P Global’s reconstitution of the Financials Index in March of 2023, including the notable additions of payment network companies Visa and Mastercard which justifiably trade at higher multiples than the typical financial company. Nonetheless, it remains fair to say that there has been multiple expansion among financial companies too, albeit not to the degree seen in the broader market index.

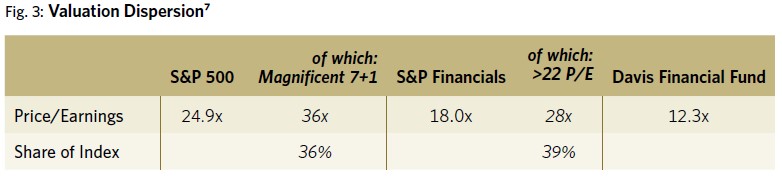

There is a significant dispersion of valuations within the Financials Index (albeit perhaps not quite of the same magnitude as in the broader index). Approximately 39% of the companies in the Financials Index (weighted by market capitalization) traded at multiples higher than 22x 2024 earnings at the end of the year (see Figure 3), and their weighted average multiple was 28x.4 Included in this group were the payment networks, alternative asset managers, financial data companies, financial software providers, insurance brokers and exchanges. Many of these are very high quality companies whose business models and management teams we admire. Stocks trading at such valuations can still be very compelling investments depending on their growth trajectory and the economics of their business, in which case we would happily be (and are) shareholders. Each of these companies has a story, and some of them might even come true. However, in our experience, for the vast majority of these companies to all grow into such a rich valuation represents an extremely high degree of difficulty.

The companies held in Davis Financial Fund skew toward the types of businesses that make up the other 61% of the Financials Index, namely U.S. money center and regional banks, consumer finance companies, property and casualty insurers, wealth managers and foreign banks. These companies are more balance sheet-intensive and should earn lower returns on capital. They bear credit and underwriting risk so their returns can be lumpy (though that isn’t necessarily negative: regular readers of these letters may recall that we often say we prefer “a lumpy fifteen to a smooth twelve”). They are regulated. These companies should trade at a valuation discount but with the fund’s weighted average P/E multiple at an estimated 12.3x5 we believe both that the discount is too wide and that the prospective absolute returns on our portfolio from here should be more than satisfactory.

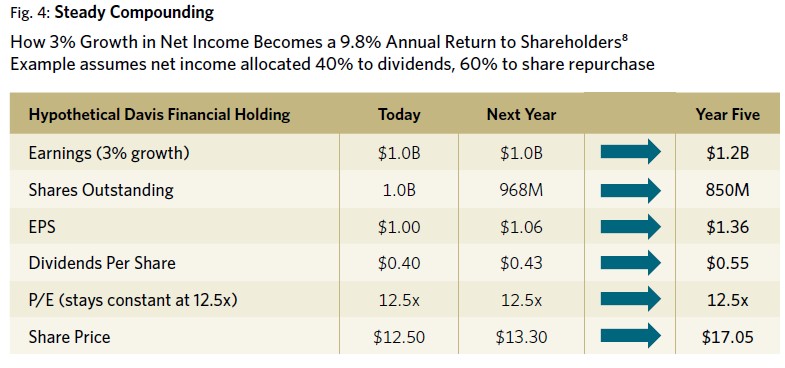

Some simple growth math can illustrate this point. The companies in our portfolio generate a weighted average return on tangible equity of approximately 15%.5 If a hypothetical company earning that return and trading at a similar 12.5x multiple could grow its income at a 3% annual rate, the total annual investment return to its shareholders would actually be +9.8% (see Figure 4), with 80% of its earnings available for distribution in the form of dividends and share repurchases.6

For the companies in our portfolio this level of growth is not that high of a bar, in our view. Moreover a portion of that growth is already “baked in” (all else equal) given that interest and investment income at our banks and insurers should continue to benefit from the repricing of their fixed rate bonds to current market yields as they mature, and because many of our banks currently are holding capital in excess of what they are likely to need when the regulatory capital rules are eventually finalized.

We don’t pretend to know the future direction of macroeconomic variables and would still consider a recession in the next year or two as quite plausible. However, we believe that the companies in our portfolio are well-positioned to withstand a recessionary environment if and when that should occur. We also believe that despite the recovery in stock prices in the last months of 2023 and in 2024 our companies’ valuations remain low enough to generate attractive returns over the next decade.

Representative Holdings

We are always mindful of John Train’s adage that “investing is the art of the specific.” Capital One is our largest holding. Best known as an issuer of credit cards, the company also is a leading player in auto financing and “direct” consumer deposit banking, and participates in commercial banking. Capital One continues to be led by its founder, Richard Fairbank, who brought to market a data- and technology-driven model that was revolutionary in consumer financial services at the time. While competitors have since emulated much of this model, we believe the company continues to be on the front foot.

Over the last decade, Capital One has grown its U.S. credit card loans and payment volumes annually at 7% and 12%, respectively, gaining share from its competitors. Importantly, it has been an astute manager of the credit cycle and has shown conservatism in its accounting for loss reserves. Earnings can admittedly be volatile from period to period but it is noteworthy that Capital One has never once in its history experienced a four-year period in which it did not earn at least a 13% return on tangible common equity. The company is valued at 12x its Owner Earnings,9 and is currently holding significant excess capital (awaiting clarity on pending rule changes, and on a regulatory decision regarding its pending merger with Discover Financial) that we believe will accelerate per share earnings growth in the coming years.

Julius Baer, another representative holding in the fund, is the leading pure-play private bank in the world, focusing exclusively on providing wealth management services to high and ultra-high net worth individuals. While the DNA of this 130-year-old private bank is Swiss, it serves clients globally and currently manages over CHF (Swiss Franc) 480 billion in assets. It is a durable, high-touch business driven by relationships and supplemented by technology and investment capabilities. Julius Baer is a rare combination of a business with modest growth and high returns. Over the last decade revenue has compounded at 6% annually and Owner Earnings at 8%, generating returns on tangible equity north of 30%. Julius Baer is currently trading at only 11x forward earnings, substantially all of which is available for dividends, buybacks and disciplined M&A.

Outlook:

Durable Across Outcomes

We remain consistent in our approach to allocating capital in our portfolio—that is, we look for companies with durable competitive advantages coupled with competent and honest managements that are priced at a discount to their intrinsic value. We invest presuming that we will own our companies through business cycles. We do not attempt to build a portfolio around a particular speculative forecast—for example, by trying to predict where interest rates or the economy will go. Rather, we strive to construct a portfolio that will perform well over the long term across a range of economic outcomes. As such, our portfolio is diversified across leading franchises earning above-average returns on capital in banking, payments, custody, wealth management, and property and casualty insurance. We remain excited by the investment prospects for the companies in Davis Financial Fund.

For more than 50 years we have navigated a constantly changing investment landscape guided by one North Star: to grow the value of the funds entrusted to us. We are pleased to have achieved strong results thus far and look forward to the decades ahead. With more than $2 billion of our own money invested in our portfolios, we stand shoulder to shoulder with our clients on this long journey.10 We are grateful for your trust and believe we are well-positioned for the future.

Alphabet, Amazon.com, Apple, Broadcom, Meta Platforms, Microsoft, Nvidia and Tesla.

Source: Bloomberg, DSA analysis.

Source: Bloomberg

Source: Bloomberg, DSA analysis.

Source: Company filings, Bloomberg and DSA analysis.

This hypothetical example is for illustrative purposes only and does not represent the performance of any particular investment. The return of a stock’s share price will vary based on a number of factors (including, but not limited to, those identified above). Equity markets are volatile and an investor may lose money.

Source: Bloomberg, company filings, Davis Advisors.

This hypothetical example is for illustrative purposes only and does not represent the performance of any particular investment. The return of a stock’s share price will vary based on a number of factors (including, but not limited to, those identified above). Equity markets are volatile and an investor may lose money.

Owner Earnings is a non-GAAP earnings metric used by DSA that adjusts for certain non-recurring and non-economic items.

As of 12/31/24, Davis Advisors, the Davis family and Foundation, our employees, and Fund directors have more than $2 billion invested alongside clients in similarly managed accounts and strategies.

This material is authorized for use by existing shareholders. A current Davis Financial Fund prospectus must accompany or precede this material if it is distributed to prospective shareholders. You should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. Read the prospectus carefully before you invest or send money.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this material. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

Objective and Risks. The investment objective of Davis Financial Fund is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Some important risks of an investment in the Fund are: stock market risk: stock markets have periods of rising prices and periods of falling prices, including sharp declines; common stock risk: an adverse event may have a negative impact on a company and could result in a decline in the price of its common stock; financial services risk: investing a significant portion of assets in the financial services sector may cause the Fund to be more sensitive to problems affecting financial companies; credit risk: The issuer of a fixed income security (potentially even the U.S. Government) may be unable to make timely payments of interest and principal; interest rate sensitivity risk: interest rates may have a powerful influence on the earnings of financial institutions; focused portfolio risk: investing in a limited number of companies causes changes in the value of a single security to have a more significant effect on the value of the Fund’s total portfolio; headline risk: the Fund may invest in a company when the company becomes the center of controversy. The company’s stock may never recover or may become worthless; foreign country risk: foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified. As of 6/30/25, the Fund had approximately 21.8% of net assets invested in foreign companies; large-capitalization companies risk: companies with $10 billion or more in market capitalization generally experience slower rates of growth in earnings per share than do mid- and small-capitalization companies; manager risk: poor security selection may cause the Fund to underperform relevant benchmarks; depositary receipts risk: depositary receipts involve higher expenses and may trade at a discount (or premium) to the underlying security; fees and expenses risk: the Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund; foreign currency risk: the change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency; emerging market risk: securities of issuers in emerging and developing markets may present risks not found in more mature markets; and mid- and small-capitalization companies risk: companies with less than $10 billion in market capitalization typically have more limited product lines, markets and financial resources than larger companies, and may trade less frequently and in more limited volume. See the prospectus for a complete description of the principal risks.

The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. As of 6/30/25, the top ten holdings of Davis Financial Fund were: Capital One Financial, 12.18%; Wells Fargo, 9.46%; JPMorgan Chase, 8.14%; Bank of New York Mellon, 5.57%; Markel Group, 5.26%; Fifth Third Bancorp, 4.87%; Berkshire Hathaway, 4.78%; Chubb, 4.31%; U.S. Bancorp, 4.27%; DBS Group Holdings, 4.13%.

Davis Funds has adopted a Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding information. This policy is described in the statement of additional information. Holding percentages are subject to change. Visit davisfunds.com or call 800-279-0279 for the most current public portfolio holdings information.

The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

We gather our index data from a combination of reputable sources, including, but not limited to, Lipper, Clearwater Wilshire Atlas and index websites.

The S&P 500 Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The index is adjusted for dividends, weighted towards stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in an index. The S&P 500 Financials Index is a capitalization-weighted index that tracks the companies in the financial sector as a subset of the S&P 500 Index. Investments cannot be made directly in an index.

After 10/31/25, this material must be accompanied by a supplement containing performance data for the most recent quarter end.

Item #4773 12/24 Davis Distributors, LLC 2949 East Elvira Road, Suite 101, Tucson, AZ 85756 800-279-0279, davisfunds.com

Financial Fund

Annual Review 2025

Managers