Managers

Share

Key Takeaways

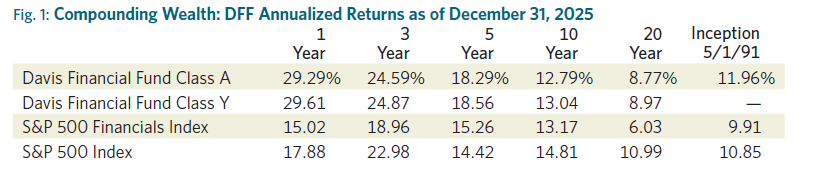

- Davis Financial Fund (DFF) returned +29.29% in 2025, exceeding the performance of the S&P Financials Index which returned +15.02% and the S&P 500 Index, which returned +17.88%.

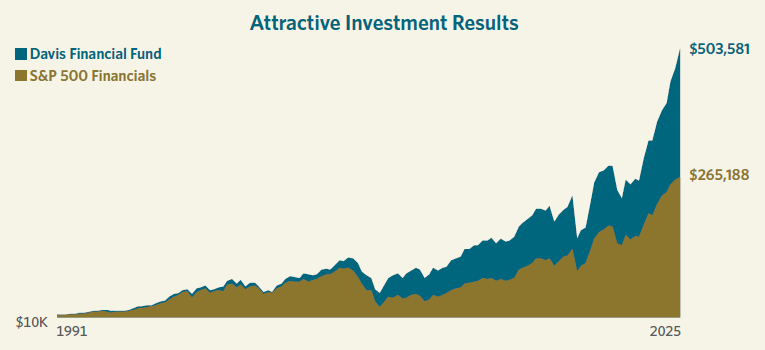

- $10,000 invested in Davis Financial Fund grew to $503,581 vs. $265,188 for S&P 500 Financials Index since inception in 1991. The fund outperformed both S&P 500 Index and S&P 500 Financials Index since inception.

- Banking, consumer lending and capital markets stocks performed well, supported by tailwinds across credit, spreads, expenses, and regulation. Investor sentiment towards financial stocks—in our view, long weighted down by memories

- We believe our portfolio companies’ valuations remain sufficiently low to provide for attractive returns over the next decade, and are particularly attractive on a relative basis versus the broader market.

- DFF has outperformed the S&P Financials Index by more than 300 basis points per year over the last five years and more than 200 basis points per year since the fund’s inception in 1991, serving as a powerful reminder of the value that active management can provide over passive index investing.

The average annual total returns for Davis Financial Fund’s Class A shares for periods ending December 31, 2025, including a maximum 4.75% sales charge, are: 1 year, 23.15%; 5 years, 17.16%; and 10 years, 12.25%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, click here or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.94%. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. All fund performance discussed within this material refers to Class A shares without a sales charge and are as of 12/31/25, unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Strategy:

Growth in Disguise

Since its inception in 1991, Davis Financial Fund (DFF) has invested in durable, well-managed financial services companies at value prices which the fund could hold for the long-term. Shelby Cullom Davis’s quip that financial services companies can be “growth companies in disguise” remains a bedrock tenet of our approach. Investors tend to place low valuations on financial companies because of their earnings volatility. However, many financial companies generate capital through the business cycle at an attractive rate which they use to pay dividends, buy back stock or otherwise deploy in ways that increase shareholder value. By focusing on economic reality rather than investor sentiment, DFF has compounded shareholder wealth at +11.96% annually over 34 years, outpacing both the S&P 500 Index and the S&P 500 Financials Index.

2025 Results

The S&P 500 Index returned +17.88% in 2025. It experienced a −19% peak-to-trough drawdown early in the year driven by fear and uncertainty principally around U.S. trade policy, but by the end of the year equity markets had stormed back and then some, making it the third year in a row of exceptional investment returns. While the U.S. has imposed its highest level of tariffs in decades, the impact on economic activity—at least so far—has been muted, and markets seem to have shrugged it off. Continued enthusiasm for the promise of artificial intelligence (AI), and the immense capital expenditures that go with it, drove further stock market gains for many technology companies.

The S&P Financials Index lagged the broader market with a return of +15.02%. The index return was driven by its large banks, capital markets firms and consumer lending companies. Its laggards included alternative asset managers, select payments companies and insurance brokers.

As noted, DFF outperformed both indices with a return of +29.29%. The biggest contributors to our relative performance were our payments and consumer lending companies (Capital One, American Express and Rocket Companies), foreign banks (Danske Bank, DBS Group and DNB Bank), selected U.S. banks (JPMorgan Chase and Wells Fargo) and capital markets companies (BNY Mellon and Julius Baer). The fund’s largest detractors from relative performance were its holding companies (Berkshire Hathaway and Exor).

Market Environment:

Sentiment Inflection Point?

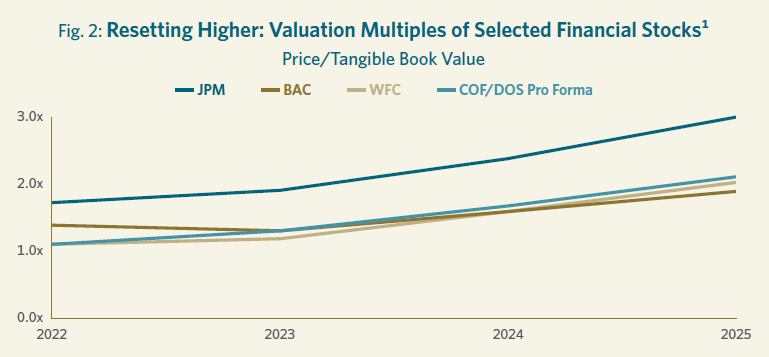

We have observed frequently in these letters that we believed the valuations of financial stocks, and banks in particular, have been weighed down by the leeriness of investors with still-vivid memories of the 2008–09 financial crisis. With 2025 being the third year in a row of strong returns for financial stocks it may well mark the year that investors finally started warming up to the sector. The S&P Financials Index still lagged the performance of the broader market in 2025, and continues to trade at an historically deep discount as measured by price/earnings ratios. However, in absolute terms investment returns on financial stocks were strong in 2025, and their valuations have begun to reset higher.

The reset in valuations can be observed in figure 2 showing trends in the price-to-tangible book value multiple of several leading financial institutions. This multiple has expanded by over 70% on a simple average basis in the past three years, a period which included the regional banking crisis of 2023. If prices convey information, the implication of this market move should reflect some combination of the following: book values are perceived to be more “solid” (i.e., there aren’t as yet unrecognized credit losses suspected around the corner), the outlook for business growth has improved, there has been a step-up in the expected long-term profitability of the businesses (i.e., higher returns on equity, including from any reductions in capital requirements), and/or the market has reduced the rate of return investors require of these stocks in discounting their future cash flows (which is to say, investor sentiment towards the group is improving).

We think probably all these factors have helped drive market returns in financial stocks, particularly banks, as there have been tailwinds across multiple dimensions. With respect to credit, the trends have been largely stable. Consumer-related losses have “normalized” upward from their low levels in the aftermath of COVID but are still trending better today than a year ago. Commercial non-performing loans on bank balance sheets have remained low and steady (despite a few high-profile exceptions last fall). In the commercial office space, banks are recognizing charge-offs but these are in line with the loss reserves previously established (i.e., no further impact on earnings or book value).

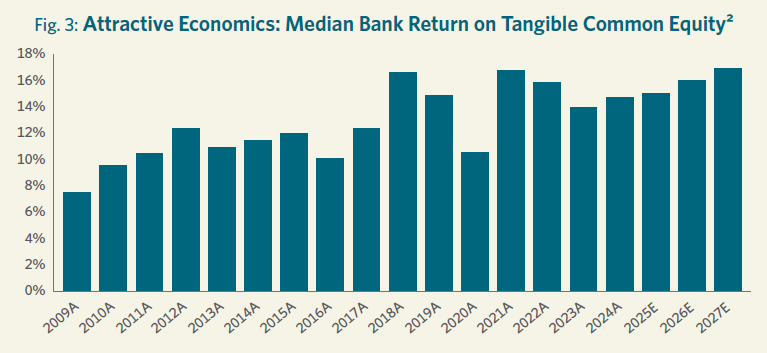

On profitability, interest spreads have begun widening again as the banks’ fixed rate assets have been rolling over at higher yields, revealing the attractive economics of their low-cost deposit franchises. Furthermore, banks have generally been able to slow the rate of growth in their expenses of late, in part through investment in their technology infrastructure (and the adoption of AI into their labor-intensive operations could cement this trend for some time to come). Many banks are currently generating returns on tangible equity in the mid-to-high teens, and management comments and targets suggest that this level should be sustainable in the medium term (or longer), as shown in figure 3.

The regulatory environment has been moving in a favorable direction as well (although arguably this was being discounted in stock prices already at the end of last year). Capital rules being finalized seem set to be far less onerous than they would have been under the prior administration, which contributes to managements’ optimistic outlooks for their ROEs. Regulators are more willing to consider M&A transactions, and there has been relief on certain supervisory limitations.

We try in our work to differentiate between intrinsic value and market value. Some of the trends observed in 2025 do represent positive changes to our estimate of intrinsic value at our portfolio companies. But many of them have been incorporated into our analysis of intrinsic value for quite some time, and it is only now that the market is seemingly recognizing them. Hence, the strong market returns experienced over the last year make it fair to say that the gap between intrinsic value and market value at many financial companies—although it still remains—has narrowed.

Portfolio Positioning:

Trimming and Redeploying

Banks, both domestic and foreign, continue to represent the majority of our holdings in the DFF portfolio. However, given their strong market performance during the year, we have trimmed our exposure to banks (primarily BNY Mellon, DBS and Danske) and redeployed that capital into property & casualty reinsurers (Everest Group and RenaissanceRe), select payments-related companies (Fiserv and Chime) and a family-controlled investment holding company, Exor.

Many of our core holdings remain the same as a year ago. Capital One continues to be the largest position in the fund. Its transformational acquisition of Discover Financial closed in May 2025. In addition to targeting annual cost synergies of $1.5 billion, management is anticipating so-called “network” synergies of $1.2 billion from transitioning certain Capital One debit and credit card volumes into Discover’s networks. Importantly, the latter synergy target is based on transitioning only a minority of Capital One’s credit card volume. Longer-term, we think the company has an opportunity to continue integrating its card-issuing activities with its card network. Looking out a few years we believe Capital One remains attractively priced at less than 10x earnings despite the potential, in our view, to earn +/−20% returns on tangible capital on average and over time.

Wells Fargo is the largest “traditional” bank in our portfolio. The company passed a milestone this year with the removal of the asset cap imposed by the Federal Reserve that has been a governor on its growth. Just as importantly, Wells Fargo has made progress over several years in right-sizing its cost structure. It has also seen positive momentum in the business lines it has recently been investing into (investment banking, credit cards and wealth management). The bank has a surplus of capital which it is working down through share repurchases, which will enhance earnings per share growth over the medium term. Despite the stock’s +36% return in 2025, Wells Fargo’s valuation at 2.1x tangible book value remains reasonable for a bank that ought to earn a high-teens return on tangible equity over time. The other so-called “super-regional” banks in the portfolio (Fifth Third Bank, U.S. Bancorp and PNC Financial) are trading at similar or better valuations, and we remain optimistic about their prospective returns.

Chubb is one of our core property & casualty insurance holdings. It is well-diversified across products and geographies. The company has consistently generated returns on equity comfortably ahead of the industry owing to a combination of running advantaged lines of business with a disciplined underwriting and operating culture. Pricing trends in the insurance markets have generally been strong in recent years, and consequently Chubb has been earning returns on tangible equity in the low 20s. While competitive forces may in time push that back toward a “normalized” level a few points lower, Chubb we believe would still be valued at 10–11x earnings looking out a few years.

After three consecutive years of strong investment returns in financials, it’s inevitable that the gap between market price and our estimate of intrinsic value would narrow. However, since the portfolio in aggregate is valued at approximately 13x this year’s earnings—a significant discount to both the broader S&P 500 Index and the S&P Financials Index—we continue to believe it is positioned to generate attractive returns over the next decade.

Outlook:

Durable Across Outcomes

We remain consistent in our approach to allocating capital in our portfolio—that is, we look for companies with durable competitive advantages coupled with competent and honest managements that are priced at a discount to their intrinsic value. We invest presuming that we will own our companies through business cycles. We do not attempt to build a portfolio around a particular speculative forecast—for example, by trying to predict where interest rates or the economy will go. Rather, we strive to construct a portfolio that will perform well over the long term across a range of economic outcomes. As such, our portfolio is diversified across leading franchises earning above-average returns on capital in banking, payments, custody, wealth management and property & casualty insurance. We remain excited by the investment prospects for the companies in Davis Financial Fund.

Together on This Journey

For more than 50 years, Davis Advisors has navigated a constantly changing investment landscape guided by one North Star: to grow the value of the funds entrusted to us. We are pleased to have achieved strong results thus far and look forward to the decades ahead. With more than $2 billion of our own money invested in our portfolios, we stand shoulder to shoulder with our clients on this long journey.3 We are grateful for your trust and are well-positioned for the future.

Source: Bloomberg, company filings and Davis Advisors. Prices as of each year-end; 2025 tangible book value per share is as of 9/30/25. Book value is adjusted for accumulated other comprehensive income related to losses on securities and hedges.

Source: Barclays Research Report (1/5/26).

As of 12/31/25, Davis Advisors, the Davis family and Foundation, our employees, and Fund directors have more than $2 billion invested alongside clients in similarly managed accounts and strategies.

This material is authorized for use by existing shareholders. A current Davis Financial Fund prospectus must accompany or precede this material if it is distributed to prospective shareholders. You should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. Read the prospectus carefully before you invest or send money.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this material. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

Objective and Risks. The investment objective of Davis Financial Fund is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Some important risks of an investment in the Fund are: stock market risk: stock markets have periods of rising prices and periods of falling prices, including sharp declines; common stock risk: an adverse event may have a negative impact on a company and could result in a decline in the price of its common stock; financial services risk: investing a significant portion of assets in the financial services sector may cause the Fund to be more sensitive to problems affecting financial companies; credit risk: The issuer of a fixed income security (potentially even the U.S. Government) may be unable to make timely payments of interest and principal; interest rate sensitivity risk: interest rates may have a powerful influence on the earnings of financial institutions; focused portfolio risk: investing in a limited number of companies causes changes in the value of a single security to have a more significant effect on the value of the Fund’s total portfolio; headline risk: the Fund may invest in a company when the company becomes the center of controversy. The company’s stock may never recover or may become worthless; foreign country risk: foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified. As of 12/31/25, the Fund had approximately 20.1% of net assets invested in foreign companies; large-capitalization companies risk: companies with $10 billion or more in market capitalization generally experience slower rates of growth in earnings per share than do mid- and small-capitalization companies; manager risk: poor security selection may cause the Fund to underperform relevant benchmarks; depositary receipts risk: depositary receipts involve higher expenses and may trade at a discount (or premium) to the underlying security; fees and expenses risk: the Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund; foreign currency risk: the change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency; emerging market risk: securities of issuers in emerging and developing markets may present risks not found in more mature markets; and mid- and small-capitalization companies risk: companies with less than $10 billion in market capitalization typically have more limited product lines, markets and financial resources than larger companies, and may trade less frequently and in more limited volume. See the prospectus for a complete description of the principal risks.

The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. As of 12/31/25, the top ten holdings of Davis Financial Fund were: Capital One Financial, 11.93%; Wells Fargo, 9.59%; JPMorgan Chase, 7.64%; Markel Group, 5.18%; Fifth Third Bancorp, 5.08%; U.S. Bancorp, 4.61%; Berkshire Hathaway, 4.35%; Chubb, 4.25%; Julius Baer Group, 4.18%; PNC Financial Services Group, 4.18%.

Davis Funds has adopted a Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding information. This policy is described in the statement of additional information. Holding percentages are subject to change. Visit davisfunds.com or call 800-279-0279 for the most current public portfolio holdings information.

The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

We gather our index data from a combination of reputable sources, including, but not limited to, Lipper, Clearwater Wilshire Atlas and index websites.

The S&P 500 Index is an unmanaged index that covers 500 leading companies and captures approximately 80% coverage of available market capitalization. Investments cannot be made directly in an index. The S&P 500 Financials Index is a capitalization-weighted index that tracks the companies in the financial sector as a subset of the S&P 500 Index. Investments cannot be made directly in an index.

After 4/30/26, this material must be accompanied by a supplement containing performance data for the most recent quarter end.

Item #4773 12/25 Davis Distributors, LLC 2949 East Elvira Road, Suite 101, Tucson, AZ 85756 800-279-0279, davisfunds.com

Financial Fund

Annual Review 2026

Managers