Episode 9Invest Systematically Regardless of Market Conditions

A habit of investing regularly takes the guesswork out of when to invest, and enables you to capitalize on short term market declines.

Share this Video

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis | 00:01 | The idea that we're not going to fix bad investment behavior, we're not going to change people's wirings, leaves us with this idea of : can we come up with strategies that will at least reduce the negative impact, the negative cost of that wiring? Ben Graham wrote about systematic investing, dollar cost averaging back in the '30s. |

| Morgan Housel | 00:27 | Yeah. |

| Chris Davis | 00:27 | And it's amazing how it is an approach that has sort of fallen out of favor. There's a view often, especially on sophisticated investment committees and so on, that this is some sort of retail strategy, and yet, it's amazing how it works. I think Ben Graham's exact quote is that he said, "It is certain to work, provided it is adhered to conscientiously and courageously." I always thought a great, the two lions in front of the Public Library here in New York were named I think by La Guardia in the Depression as Courage and Fortitude. |

| Chris Davis | 01:05 | I would say conscientious and courageous are a good mindset for what an advisor can give a client. And systematic investing is one of the best ways, because this idea that I'm taking a fixed amount of my paycheck, whether it's through my 401(k), or a fixed amount each month, or your mother-in-law comes and says, "Oh my God, the market's up a lot. I want to get invested. What do I do?" If you can spread that decision out over time and average in over time, you so significantly reduce the investor behavior penalty, and you get a good outcome in every possible market condition, except for one, which is that the market never goes down again. |

| Morgan Housel | 01:47 | Right. |

| Chris Davis | 01:47 | And you sort of think, "Well, okay, I'm willing to take that risk." |

| Morgan Housel | 01:50 | Yes. |

| Chris Davis | 01:50 | But what do you think about why it is that something as simple and effective just can't seem to gain traction in the minds of strategists and tacticians, and pension advisors and consultants? |

| Morgan Housel | 02:08 | I think investing is one of the only fields that exists where it's obvious that the harder you try, the worse you will do, and it's not intuitive, because most fields are not like that. If you want to become, there's stories about Tiger Woods when he was young going to a golf range and hitting 1,000 golf balls, or of Jordan going to the basketball court and just dribbling for 10 hours, not even shooting a ball, just dribbling for 10 hours. Most fields, the harder you try, the more you work, the better you will do, and I think for the huge majority of investors, not all, but the vast majority, it's the opposite. It's just so counterintuitive to how most industries work, that it's not like that. |

| Morgan Housel | 02:46 | What's interesting with dollar cost averaging is that if you were to backtest asset allocation strategies, even with the benefit of cherry-picking with hindsight data, and to backtest and say, "Okay, how about what if I only invested when the economy bottomed, and I bought here and I sold there?" And even if you're cherry-picking the data and then you compare, "Okay, how does that compare to dollar cost averaging?" dollar cost averaging will still win nine times out of 10. Even if you know what the market's going to do next with hindsight, it's still hard to beat dollar cost averaging. A big part of that too is not just the math of how that works, of being able to buy at lower prices when the market pulls back, it's you are the easiest person to fool. |

| Morgan Housel | 03:28 | People fool themselves, and when you fool yourself, it's very persuasive. When you have an argument in your head of, "I can do this, I'm smart. I can see this thing coming," you are fooling yourself. You're easier to fool yourself more than you are to be fooled by other people, and then, so if you can take the thought process out of it and just systematize it, and then you don't have to say, "Okay, I'm going to buy when the market feels like it's cheap, when it's gone below this PE ratio," whatever it might be. Just create a system that you're always going to buy come hell or high water, that really changes it. |

| Morgan Housel | 03:58 | A lot of that reason is because people really misjudge how they will feel when the market conditions change. When the market is going well, everyone thinks they have a high risk tolerance. And if I said to you today, I said, "How would you feel if the market fell 40%?" Most people would say, "That would be great. That would be an opportunity for me to buy more," because when I ask you that when the market is going well, you imagine a world in which everything else is the same, except stock prices are 40% cheaper. And in that world, it seems like an opportunity. But by and large, the reason that the market might fall 40% is because there's a war that you have no idea how it's going to end. There's a virus that might kill you and your family. There's the banking system might not be around next week. |

| Morgan Housel | 04:42 | That's why the market falls 40%, and in that world, it's so easy to change your mind about what you think your risk tolerance is or where you see the world going next. So if you can take out all the analysis from the equation and just say, "I'm going to buy on the first Friday of every month," whatever it might be, and there's no analysis whatsoever in terms of valuation or what the economy is going to do, it's just a pure system. If you can actually adhere to that, which is the difficult part, it is so hard, even with hindsight, to find an asset allocation strategy that will beat dollar cost averaging. |

| Chris Davis | 05:14 | Yeah, and to the extent that that is what the 401(k) program ultimately could be if advisors are able to help clients see that. The trouble with most 401(k) plans is that people are not looking at the investment side, so all the money is going into a money market fund and things like that. The 401(k), where a certain amount of your paycheck is going in month after month after month, sort of creates the perfect dollar cost averaging backdrop. And if it's simply going into the market on that regular basis, it will produce a wonderful return. It's just often, it isn't. People fail to take advantage of how good that structure could be. They wait until they have a big pile of money in a money market fund, and then they hire somebody and then go into whatever is the hot dot at that time. |

| Morgan Housel | 06:03 | Absolutely. |

Chris & Morgan Bios

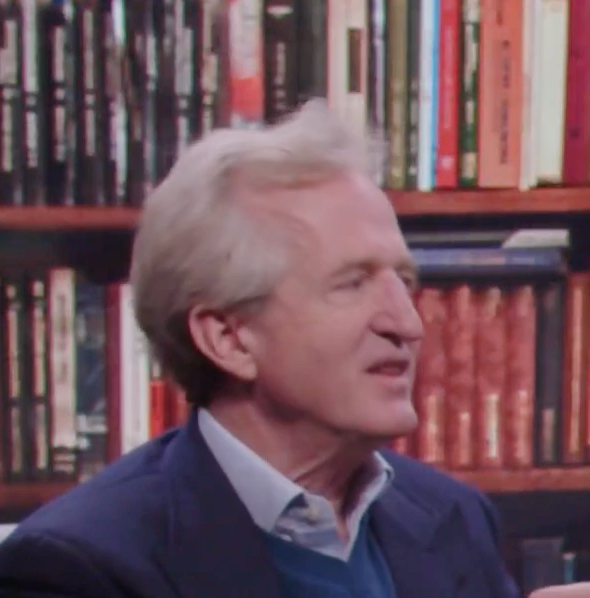

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.