Managers

Share

Executive Summary

- Davis New York Venture Fund returned 30.00% in 2023 compared to 26.29% for the S&P 500 Index. The fund has consistently grown wealth for shareholders since its inception in 1969.

- The rise in interest rates that started in 2022 is unwinding the free money era which had persisted since the global financial crisis in 2008–2009. We believe the fund is very well-positioned for this new and potentially more volatile environment.

- Our portfolio includes companies with resilient growth, those with durable earnings power and significant free cash flow, and those with some combination of long-lived assets, pricing power, competitive advantage, balance sheet strength, proven management and attractive valuation.

The average annual total returns for Davis New York Venture Fund’s Class A shares for periods ending March 31, 2024, including a maximum 4.75% sales charge, are: 1 year, 31.39%; 5 years, 10.60%; and 10 years, 9.22%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends and capital gain distributions. Investment return and principal value will vary so that, when redeemed, an investor’s shares may be worth more or less than their original cost. For most recent month-end performance, click here or call 800-279-0279. Current performance may be lower or higher than the performance quoted. The total annual operating expense ratio for Class A shares as of the most recent prospectus was 0.92%. The total annual operating expense ratio may vary in future years. Returns and expenses for other classes of shares will vary.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. All fund performance discussed within this material refers to Class A shares without a sales charge and are as of 12/31/23 unless otherwise noted. This is not a recommendation to buy, sell or hold any specific security. Past performance is not a guarantee of future results. The Attractive Growth and Undervalued reference in this material relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Fund performance will be positive as equity markets are volatile and an investor may lose money.

Performance:

Building Long-Term Wealth

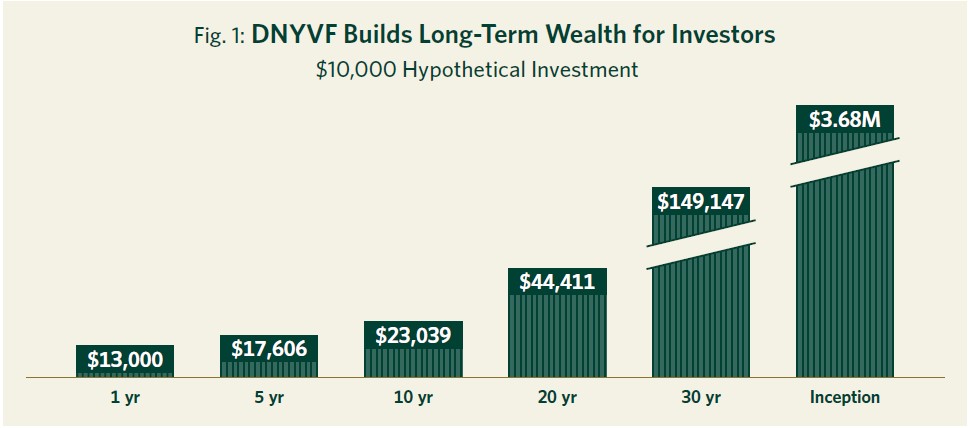

Davis New York Venture Fund (DNYVF) returned 30.00% in the year ended December 31, 2023, and has grown wealth for shareholders in all periods since its inception. The longer a shareholder has been invested in the fund, the more their savings have grown (see Figure 1).

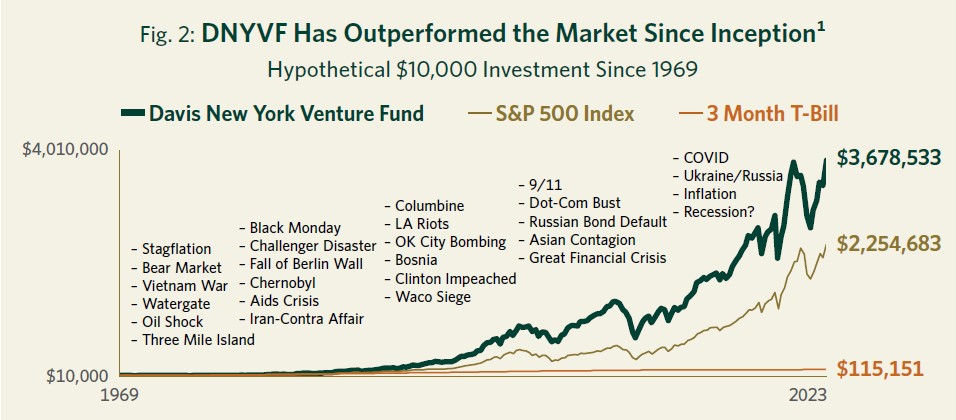

DNVYF 2023 results exceeded the 26.29% return on the S&P 500 Index by approximately four percentage points, adding to the fund’s long-term record of outperformance since its inception in 1969. This outperformance, compounded over the fund’s life, means an initial $10,000 investment made at inception would have grown to $3.68 million by the end of 2023 (see Figure 2). This is roughly 60% more than if the same $10,000 had been invested in a passively managed S&P 500 Index fund over the same period. It is more than 3,000% higher than would have been achieved if the $10,000 had been held in money market funds for the same length of time.

Market Perspective:

Rationality Returns After a Decade of Distortion

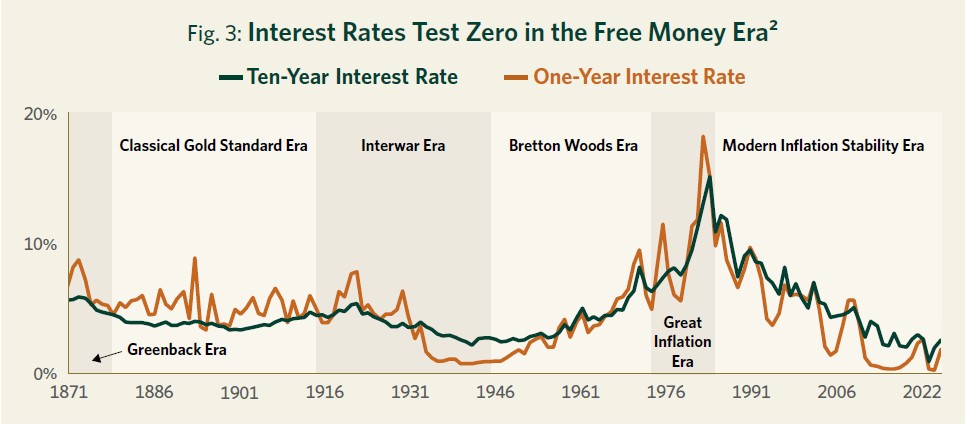

The fund’s recent outperformance coincides with the overdue bursting of the easy-money bubble. This shift to a more normal environment after more than a decade of distortions caused by near zero percent interest rates began on March 16, 2022, when the Federal Reserve announced the first of 11 consecutive increases in the federal funds benchmark rate, the steepest rate of change ever. Before discussing how our portfolio is well-positioned to take advantage of this return to normalcy, it is important to understand just how extreme the previous decade of interest rate distortion had become. During this so-called free-money era, both short- and long-term interest rates approached their lowest levels in recorded history (see Figure 3).

Interest rate suppression (both directly and indirectly through a bond purchase policy known as quantitative easing) became a matter of national policy, first in response to the great financial crisis of 2008–2009, and then the COVID-19 crisis in 2020–2021. It was accompanied by dramatic increases in government spending and ballooning federal deficits.

“A return to more normal interest rates creates headwinds for many of the market darlings that led for so long, and tailwinds for the durable, attractively valued businesses at the heart of our investment discipline.”

As the cost of money approached zero despite huge increases in money supply, these policies created significant market distortions. Assets were mispriced, risks ignored, inflation allowed to metastasize, and valuation discipline penalized.

Given the sheer magnitude of these distortions, the great unwinding that began in 2022 still has a long way to go. While we do not expect further interest rate increases in the short term, and in fact believe that interest rates may come down over the next year as the inflation outlook normalizes, the free money bubble that began in 2009 has burst and the reckoning will continue.

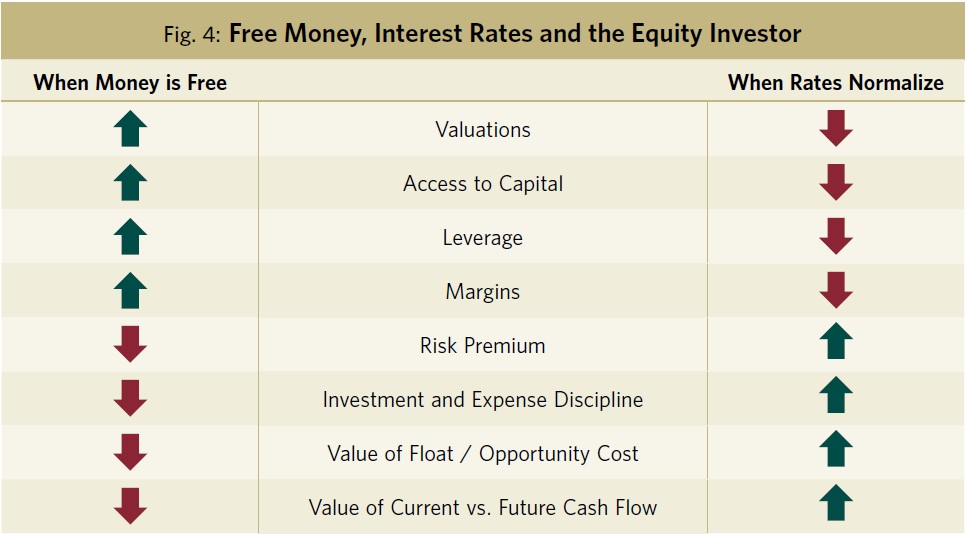

For investors like us who have always adhered to a valuation discipline, this unwinding is an overdue but volatile return to normalcy after more than a decade of delusion. As we return to reality, we are encouraged that the companies we own (including our carefully selected banks) are well-positioned for this changing environment and that DNYVF has outperformed the indices since the free money era ended. While short-term results are unpredictable, it should come as no surprise that investors are once again seeking durability, profitability, cash production, valuation and balance sheet strength. It is these characteristics that allow companies to better navigate a period of higher interest rates and economic uncertainty. Returning to more normal interest rates may create headwinds for many of the market darlings that led for so long, and tailwinds for the type of durable, attractively valued businesses that lie at the heart of our investment discipline (see Figure 4).

This reckoning is already wreaking havoc for investors who believed that 2008–2022 was the new normal in which money was free, valuation irrelevant, and profitless growth could be funded forever. Mismanaged banks that prioritized earnings growth over risk control—like Silicon Valley and First Republic (neither of which we owned)—collapsed. Leveraged pension funds in the U.K. required government bailouts. Former market darlings like Spotify, Shopify, Square, Zoom, WeWork, Robinhood and Peloton are down approximately 50–100% from their all-time highs.

As the effects of higher-cost capital roll through the system, the examples above are just prologue. For instance, we expect that many well-known venture capital and private equity funds have been slow to write down the carrying value of portfolio holdings, and are likely to report dismal results in the years ahead. Companies with large amounts of maturing low-cost debt may have trouble refinancing at rates that don’t erode their profitability, assuming they can refinance at all. Holders of commercial real estate that was levered when cap rates were below today’s risk-free rate are likely to have their equity significantly diminished or even wiped out.

Above all, for the first time in our nation’s history, interest payments on our nation’s growing debt have surpassed defense spending and are poised to rise steeply as maturing low-cost debt is refinanced at higher rates. This growing interest rate burden in the face of the somewhat dysfunctional state of affairs in our nation’s capital reinforces our focus on durable and resilient business models.

“The carefully selected group of companies in DNYVF portfolio show a rare combination of durable growth and discount prices, a value investor’s dream that positions us well for the years ahead.”

Interestingly, while many of the examples above are well-known, the largest and most important losses do not seem to be getting much attention. Perversely, these losses are in exactly that portion of investors’ portfolios that have been considered the safest and least volatile. After more than 40 years of falling interest rates, investors came to view government bonds as pillars of safety that could be relied on to preserve value in periods of volatility and uncertainty. We have strongly disagreed for years, calling bonds purchased at low interest rates “return-free risk” rather than “risk-free return.” From March 2022 to today, prices of long-term government bonds have declined 25–35%. These losses in the face of relatively high inflation remind us why veteran investors, whose careers extended into the half century of rising interest rates that preceded four decades of falling rates called bonds “certificates of confiscation.”

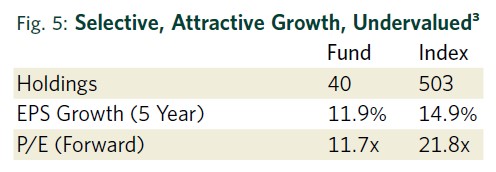

While recent returns have been strong, our DNYVF portfolio remains significantly undervalued when compared to the market averages. Our carefully selected group of companies trade at only 12 times forward earnings (see Figure 5). This is a 46% discount to the S&P 500 Index despite these companies having grown their earnings per share almost 12% per year over the last five years. This rare combination of durable growth and discount prices is a value investor’s dream that positions us well for the years ahead.

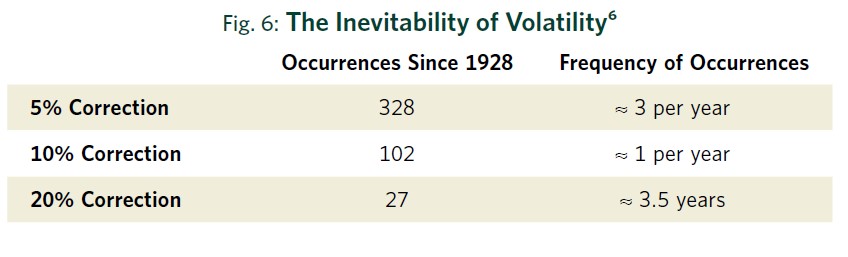

Our long-term conviction includes the recognition that short-term corrections and surprises are an unpleasant but inevitable part of the investment landscape. History shows investors should expect a 10% correction on average once per year and a 20% correction every 3.5 years (see Figure 6). Given the excesses of the last decade, we see no reason to imagine that the future will be immune from shocks, crises, volatility and corrections. Our job is not to try to predict the unpredictable but rather to prepare for the inevitable.

In mentally preparing for these challenging but inevitable periods, investors should bear in mind the framework described by Morgan Housel, the author of two must-read books, The Psychology of Money and Same as Ever. In a recent visit with our firm, excerpts of which are posted on our website,4 Morgan observed that:

“We know that markets can provide good long-term returns, but nothing good in life is free. Everything worthwhile pursuing has a cost of admission attached to it. In investing, that cost is putting up with and enduring a never-ending chain of uncertainty and volatility and ups and downs and booms and busts. [The] subtle mindset shift when you're enduring volatility [is not] to think ‘I screwed up’ [or] ‘my advisor screwed up’. This is not a fine. This is just the bill coming due to earning good long-term returns over time. The mistake a lot of investors make is that rather than viewing it as a fee that is worth paying, a cost of admission that's worth paying, they want to avoid the fee. They want the returns without the volatility. A big insight for long-term investors is understanding that the fee is worth paying. The cost of admission is worth it. If you can put up with a never-ending ceaseless chain of volatility and surprises and stick around for 10, 20, 30, 40, 50 years, it is so worth it to pay that fee.”5

Portfolio Positioning:

Proven Business Models Back in Fashion

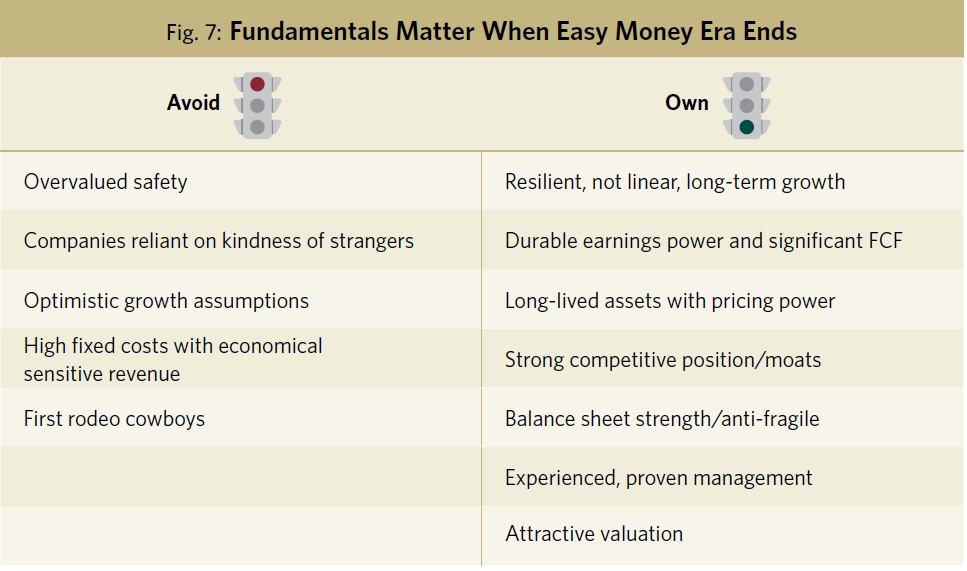

Business fundamentals matter more than ever in a period of interest rate normalization, with its market volatility and economic uncertainty. Many darlings of the free money era remain overvalued and should be avoided (see Figure 7). Specifically, companies with anemic growth and sky-high valuations that are perceived as “safe” simply because their prices have (so far) held up are vulnerable to disappointment and downward revision. In this category, we include many utilities and consumer companies whose balance sheets and business models are riskier than they once were.

Similarly at risk are those companies whose business models rely on unsustainably high growth assumptions or access to cheap capital, or which have high fixed costs and economically sensitive revenue. Finally, unproven managers who have never managed through a downturn (a group we refer to as “first rodeo cowboys”) may have difficulty adapting to the changing environment.

On the other side of the ledger, we are finding bargains as companies with durable and proven business models come back into fashion. These include companies with resilient (but not necessarily smooth) growth, those with durable earnings power and significant free cash flow, and those with some combination of long-lived assets, pricing power, competitive advantage, balance sheet strength, proven management and attractive valuation. Such high-quality businesses are well-represented in our portfolio and well-positioned in this uncertain world.

Bearing in mind John Train’s wisdom that “investing is the art of the specific,” we now turn to a detailed review of the themes, sectors and companies in DNYVF portfolio that positions us well in the current environment of uncertainty.

Financials: Growth Stocks in Disguise

The financial sector makes up the largest weighting in our fund. This emphasis reflects our belief that since the great financial crisis of 2008–2009, investors have significantly undervalued financial companies in general and banks in particular. The undervaluation stems from the scars and memories of that crisis, and a failure to appreciate that stricter regulations and significantly more capital have made select, well-managed large banks far safer and more attractive than ever.

The value that we place on the terms “well-managed” and “large” was reinforced by the collapse in early 2023 of three smaller and riskier institutions—Silicon Valley Bank, Signature Bank and First Republic Bank. We owned none of these, not because we hadn’t studied them over the years, but because our review of their balance sheets showed an interest rate mismatch between their assets (securities and loans) and their liabilities (customer deposits). We did not predict their collapse, but we did consider that they had taken unnecessary risk that would significantly dampen their future earnings power. This seemed to be a clear indication of an aggressive, short-term culture. For example, in a 2022 research memo written prior to the crisis, we sounded a cautionary note, pointing out that, “At First Republic Bank, [we are] rather startled by their choices. It’s not just that their assets are largely locked into fixed rates, but also that…[we] believe their deposit base is going to be far more rate-sensitive than that of a traditional regional bank.”

The collapse of these three poorly managed banks created a panic. The prices of virtually all banks declined sharply, but the value of the large, high-quality banks we own actually increased throughout this period. Despite blaring headlines about bank runs, most of our carefully selected banks grew deposits and earnings substantially. Today, their capital ratios are at or near all-time highs. They have benefited from higher interest rates and, most importantly, in July 2023 all passed the stringent stress test overseen by the Federal Reserve.

This stress test models a dramatic recession, meaningfully worse than the 2008–2009 crisis. It assumes a 3.5% decline in gross domestic product, a 10% unemployment rate, a 37% decline in residential real estate prices, a 40% decline in commercial real estate prices and a 55% decline in the stock market. The resilience and strength that an institution needs to weather such a storm, combined with proven economies of scale in branding and technology, should drive market share gains and growth for years to come. Our financial sector holdings—such as Capital One Financial, Wells Fargo, BNY Mellon, JP Morgan Chase and U.S. Bancorp—trade at some of the lowest valuations in the market, and deserve to be revalued upwards over time. In the meantime, their growing capital, increasing dividends and shrinking share bases create value while we wait.

Durable Industrials: Non-Linear Growth Paths

As concern about a looming recession has grown, we have found opportunities in long-term growth companies whose short-term earnings may be impacted by an economic downturn. Investors are paying a premium for slow-growing companies that are not economically sensitive in the short term, but are undervaluing companies whose long-term earnings power will grow more substantially over time. As discussed above, the tendency to overweight the pattern of earnings relative to the amount of earnings is more a matter of psychology than economics. In today’s market, nervous investors are in essence paying twice as much for a hypothetical business that will earn $10 million, $10.5 million and $11 million over the next three years than one which will earn $10 million, $9 million and $13 million, even though the second one is worth more. In our portfolio, examples of resilient but non-linear growth companies with long-lived assets and strong competitive positions include Berkshire Hathaway, Applied Materials, Teck Resources, Samsung and Owens Corning.

Healthcare: Finding Value in a High-Cost Sector

The healthcare industry has been a growing part of the U.S. economy for decades. As a result, many companies in this sector trade at high valuations, reflecting their robust but well-known reputation for growth. For value-conscious investors like us, investing in healthcare requires looking beyond the obvious to identify businesses that have exposure to this growth industry but trade at low valuations. We recognize that the constantly rising cost of healthcare is unlikely to go on forever, so we are particularly drawn to companies whose products or services play some role in managing or reducing the cost of care.

As a result, we have positions in Cigna Group, a well-regarded provider of managed care, Viatris, a leading manufacturer of low-cost branded generic drugs, and Quest Diagnostics, whose centralized facilities provide diagnostic medical tests at a fraction of the cost of hospital labs.

Online Platforms: Controversial Blue Chips

For many years, we have referred to the leading online platforms such as Alphabet, Meta and Amazon as the blue chips of tomorrow. Their economies of scale, network effects, strong competitive positions and profitable business models combine to make them some of the best businesses we have ever seen. The success of these juggernauts has attracted waves of regulatory scrutiny and relentless negative press coverage. As a result, investor sentiment can swing precipitously from euphoria to fear, providing opportunities for price-conscious investors.

For example, a little more than a year ago we shared with you a detailed review of our investment in Meta, the holding company that includes Facebook, Instagram and WhatsApp, whose shares had recently plunged. We wrote, “Meta currently languishes under a cloud of skepticism…Down more than 65% from its high, we believe all of the risks more than discounted and have added to our holding.” From the low of 2022 to today, Meta shares have soared almost 300%, making it the largest contributor to our 2023 results

While we are not short-term traders, the enormous price volatility of these online tech leaders has led us to be opportunistic. We trim when prices are high and add when they are low. Recently, as these companies have swung back into favor, we have trimmed our holdings in both Meta and Alphabet. We have also added to our position in a lesser known, but spectacularly well-managed, company called IAC, a holding company which currently owns 18% of MGM Resorts (whose shares we also own directly), as well as stakes in Angi, Dotdash-Meredith (owner of media brands such as People, Investopedia and Better Homes & Gardens), Turo and a range of smaller internet and media properties.

Select International Leaders: Economics Trumps Geography

The U.S. stock market has outperformed virtually all international markets over the last decade or more, leading many investors to give up on international investing and ignore all companies whose shares trade outside of the U.S. Consequently, select companies whose business results, competitive positions and management quality would lead investors to pay a premium if the shares were listed in the United States trade at steep discounts, even allowing for regulatory differences and currency exposure.

We invest in international companies that embody the same characteristics of durability, quality, valuation and management as our U.S.-domiciled holdings. Examples include DBS Group Holdings, the largest bank in Singapore (also known as the “Fort Knox of Asia”), Danske Bank, the leading bank of Denmark, Ping An Insurance, the largest insurance company in Asia, whose name literally translates as “safe and sound,” and Julius Baer Group, one of the most respected wealth managers in Switzerland.

Outlook:

Positioned to Grow Wealth Over Time

From 2008–2022, artificially suppressed interest rates created a period of unprecedented economic and market distortion. Throughout that period, fundamental investment analysis—which rests on discounted present value, cost of capital and risk management—became largely irrelevant. Valuation discipline fell out of favor and the market increasingly rewarded momentum and speculation.

All that changed in the first quarter of 2022 when interest rates began a long overdue period of normalization. The effects of this return to normalcy will be volatile and will unfold over a long period of time. Companies and investors that are not well-prepared face big problems, only some of which have come to light. As this bubble bursts, we expect many more unpleasant surprises, particularly in the most levered and speculative areas of the market and economy.

For Davis Advisors, this transition marks a return to normalcy. The key pillars of success in this tumultuous environment are the cornerstones of our investment discipline: cash generation, conservative capital structure, durable business model, low valuation and proven management. We are pleased that our fund has outperformed during this transition, and is strongly positioned to build wealth in the decade to come.

Our long-term conviction includes the recognition that short-term corrections and surprises are an unpleasant but inevitable part of the investment landscape. Given the excesses of the last decade, we expect the coming years to be volatile. As always, our job is to be neither pessimists nor optimists, but realists.

In conclusion, as stewards of our clients’ savings our most important job is growing the value of the funds entrusted to us. With more than $2 billion of our own money invested alongside that of our clients, we are on this journey together.7 This alignment with our clients is uncommon in our industry; our conviction in our portfolio of carefully selected companies is more than just words.

We are grateful for your trust and are well-positioned for the future.

Source: Davis Advisors and Morningstar. Graph represents performance from 1/1/70 to 12/31/23. Past performance is not a guarantee of future results.

Source: Robert J. Shiller (Yale University); Federal Reserve Board and Federal Reserve economic data.

Attractive Growth and Undervalued reference in this material relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Fund’s performance will be positive as equity markets are volatile and an investor may lose money. Past performance is not a guarantee of future returns. Five-year EPS Growth Rate (5-year EPS) is the average annualized earnings per share growth for a company over the past 5 years. The values shown are the weighted average of the 5-year EPS of the stocks in the Fund or Index. Approximately 4.11% of the assets of the Fund are not accounted for in the calculation of 5-year EPS as relevant information on certain companies is not available to the Fund’s data provider. Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Fund’s data provider. These values for both the Fund and the Index are the weighted average of the stocks in the portfolio or Index.

There is no guarantee that an investor will make money over the long term or the short term.

Source: Ned Davis Research, Inc. As of 1/12/24.

As of 12/31/23 Davis Advisors, the Davis family and Foundation, our employees, and Fund directors have more than $2 billion invested alongside clients in similarly managed accounts and strategies.

This material is authorized for use by existing shareholders. A current Davis New York Venture Fund prospectus must accompany or precede this material if it is distributed to prospective shareholders. You should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. Read the prospectus carefully before you invest or send money.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this material. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

Objective and Risks. The investment objective of Davis New York Venture Fund is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Some important risks of an investment in the Fund are: stock market risk: stock markets have periods of rising prices and periods of falling prices, including sharp declines; common stock risk: an adverse event may have a negative impact on a company and could result in a decline in the price of its common stock; financial services risk: investing a significant portion of assets in the financial services sector may cause the Fund to be more sensitive to problems affecting financial companies; foreign country risk: foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified. As of 3/31/24, the Fund had approximately 18.8% of net assets invested in foreign companies; China risk – generally: investment in Chinese securities may subject the Fund to risks that are specific to China. China may be subject to significant amounts of instability, including, but not limited to, economic, political, and social instability. China’s economy may differ from the U.S. economy in certain respects, including, but not limited to, general development, level of government involvement, wealth distribution, and structure; headline risk: the Fund may invest in a company when the company becomes the center of controversy. The company’s stock may never recover or may become worthless; large-capitalization companies risk: companies with $10 billion or more in market capitalization generally experience slower rates of growth in earnings per share than do mid- and small-capitalization companies; manager risk: poor security selection may cause the Fund to underperform relevant benchmarks; depositary receipts risk: depositary receipts involve higher expenses and may trade at a discount (or premium) to the underlying security; emerging market risk: securities of issuers in emerging and developing markets may present risks not found in more mature markets; fees and expenses risk: the Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund; foreign currency risk: the change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency; and mid- and small-capitalization companies risk: companies with less than $10 billion in market capitalization typically have more limited product lines, markets and financial resources than larger companies, and may trade less frequently and in more limited volume. See the prospectus for a complete description of the principal risks.

The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. As of 3/31/24, the top ten holdings of Davis New York Venture Fund were: Meta Platforms, 9.03%; Berkshire Hathaway, 8.43%; Wells Fargo, 6.99%; Capital One Financial, 6.83%; Amazon.com, 6.10%; Applied Materials, 5.26%; Humana, 3.63%; U.S. Bancorp, 3.39%; Viatris, 3.29%; Danske Bank, 3.18%.

Davis Funds has adopted a Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding information. This policy is described in the statement of additional information. Holding percentages are subject to change. Visit davisfunds.com or call 800-279-0279 for the most current public portfolio holdings information.

The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

We gather our index data from a combination of reputable sources, including, but not limited to, Lipper, Wilshire and index websites.

The S&P 500 Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The index is adjusted for dividends, weighted towards stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in an index.

After 7/31/24, this material must be accompanied by a supplement containing performance data for the most recent quarter end.

New York Venture Fund

Annual Review 2024

Managers